Buffett said he will recommend to Berkshire Hathaway’s board that Vice Chairman Greg Abel should replace him.

Revered investor Warren Buffett has shocked an arena full of his shareholders by announcing that he wants to retire at the end of the year.

Buffett said he would recommend to Berkshire Hathaway’s board on Sunday (Monday AEST) that vice chairman Greg Abel should replace him.

“I think the time has arrived where Greg should become the chief executive officer of the company at year end,” Buffett said.

READ MORE: Dutton hoped write a chapter in history. He ended up being a footnote

Abel has been Buffett's designated successor for years, and he already manages all of Berkshire's noninsurance businesses. But it was always assumed that he would not take over until after Buffett's death. Previously the 94-year-old Buffett always said he had no plans to retire.

Buffett announced the news at the end of a five-hour question and answer period without taking any questions about it.

He said the only board members who knew this was coming were his two children, Howard and Susie Buffett.

Abel, who was sitting next to Buffett on stage, had no warning.

READ MORE: Federal Election 2025 Results Tracker

Abel returned an hour later without Buffett to conduct the company's formal business meeting, and he responded to the news.

“I just want to say I couldn’t be more humbled and honored to be part of Berkshire as we go forward,” Abel said.

Many investors said Abel would do a good job running Berkshire, but it remained to be seen how good he would be at investing Berkshire's cash.

Buffett endorsed him on Saturday by pledging to keep his fortune invested in the company.

“I have no intention — zero — of selling one share of Berkshire Hathaway. I will give it away eventually,” Buffett said.

“The decision to keep every share is an economic decision because I think the prospects of Berkshire will be better under Greg’s management than mine.”

Thousands of investors in the Omaha arena gave Buffett a prolonged standing ovation after his announcement in recognition of his 60 years leading the company.

CFRA research analyst Cathy Seifert said it had to be hard for Buffett to reach this decision to step down.

“This was probably a very tough decision for him, but better to leave on your own terms,” Seifert said. “I think there will be an effort at maintaining a ‘business as usual’ environment at Berkshire. That is still to be determined.”

Abel expected to do well

In many respects, Abel has already been running much of the company for years.

But he hasn't been managing Berkshire's insurance operations or deciding where to invest all of its cash.

He will now take those tasks on, but vice chairman Ajit Jain will remain to help oversee the insurance companies.

Investment manager Omar Malik of Hosking Partners in London said before Buffett’s announcement that he wasn’t worried about Berkshire’s future under Abel.

“Not really (worried). He’s had such a long time alongside Warren and a chance to know the businesses,” Malik said about Abel. "The question is will he allocate capital as dynamically as Warren? And the answer is no. But I think he’ll do a fine job with the support of the others.”

Cole Smead of Smead Capital Management said he wasn't surprised Buffett was stepping down after watching him on Saturday because the 94-year-old wasn't as sharp as in past years.

At one point, he made a basic math mistake in one of his answers. At other points, he got off track while telling stories about Berkshire and his investing without answering the question he was asked.

Abel is well regarded by Berkshire's managers and Buffett has praised his business acumen for years. But he will have a hard time matching Buffett's legendary performance, and since he doesn't control 30 per cent of Berkshire's stock like Buffett does, he won't have as much leeway.

“I think the challenge he’s going to have is if anyone is going to give him Buffett or (former Vice Chairman Charlie) Munger’s pass card? Not a chance in God’s name," Smead said.

READ MORE: Labor wins election on disastrous night for Dutton, Coalition

Buffett always enjoyed a devoted following among shareholders.

Buffett has said that Abel might even be a more hands-on manager than he was and get more out of Berkshire’s companies. Managers within the company say they have to be well prepared before talking to Abel because they know he will ask tough questions.

Steven Check, president of Check Capital Management, said he never thought he would see Buffett retire.

“I didn't think he would retire while his mind is still working so well, nor did I think it'd happen at the annual meeting,” Check said. “But overall I'm very happy for him.”

Buffett earlier warned that Trump's tariffs were harmful

Earlier Saturday, Buffett warned of dire global consequences from President Donald Trump's tariffs while telling the thousands of investors gathered at his annual meeting that “trade should not be a weapon” but "there's no question that trade can be an act of war".

Buffett said Trump's trade policies have raised the risk of global instability by angering the rest of the world.

“It’s a big mistake in my view when you have 7.5 billion people who don’t like you very well, and you have 300 million who are crowing about how they have done,” Buffett said as he addressed the topic on everyone's mind at the start of the Berkshire Hathaway shareholders meeting.

READ MORE: Trump trade czar slams Australia for 'frontal assault' on US aluminium sector

While Buffett said it was best for trade to be balanced between countries, he did not think Trump was going about it the right way with his widespread tariffs. He said the world would be safer if more countries were prosperous.

Market turmoil doesn't create big opportunities

Buffett said he just did not see many attractively priced investments that he understood these days, so Berkshire was sitting on $US347.7 billion ($538.4 billion) in cash, but he predicted that one day Berkshire would be “bombarded with opportunities that we will be glad we have the cash for".

Buffett said the recent turmoil in the markets that generated headlines after Trump's tariff announcement last month was "really nothing".

He dismissed the recent drop as relatively small. He cited when the Dow Jones industrial average went from 240 on the day he was born in 1930 down to 41 during the Great Depression as a truly significant drop in the markets. Currently the Dow Jones Industrial Average sits at 41,317.43.

“This has not been a dramatic bear market or anything of the sort," he said.

Buffett said he had not bought back any of Berkshire's shares this year either because they did not seem to be a bargain.

Investor Chris Bloomstran, who is president of Semper Augustus Investments Group, told the Gabelli investment conference on Friday that a financial crisis might be the best thing for Berkshire because it would create opportunities to invest at attractive prices.

“Berkshire needs a crisis. I mean Berkshire thrives in crisis,” Bloomstran said.

Berkshire meeting attracts thousands

The meeting attracts some 40,000 people every year who want to hear from Buffett, including some celebrities and well-known investors.

This year, Hillary Rodham Clinton also attended. Clinton was the last candidate Buffett backed publicly because he has shied away from politics and any controversial topic in recent years for fear of hurting Berkshire’s businesses.

One investor even camped outside the arena overnight to be first in line.

Devan Bisher, 72, said he had faith in Berkshire's future and did not plan to sell the stock he started buying in the 1980s.

“It’s been a good train to ride,” Bisher said, “and I’m going to stay with it.”

DOWNLOAD THE 9NEWS APP: Stay across all the latest in breaking news, sport, politics and the weather via our news app and get notifications sent straight to your smartphone. Available on the Apple App Store and Google Play.

The contenders to replace Peter Dutton

The contenders to replace Peter Dutton

Elon Musk is now the 'owner' of his own city

Elon Musk is now the 'owner' of his own city

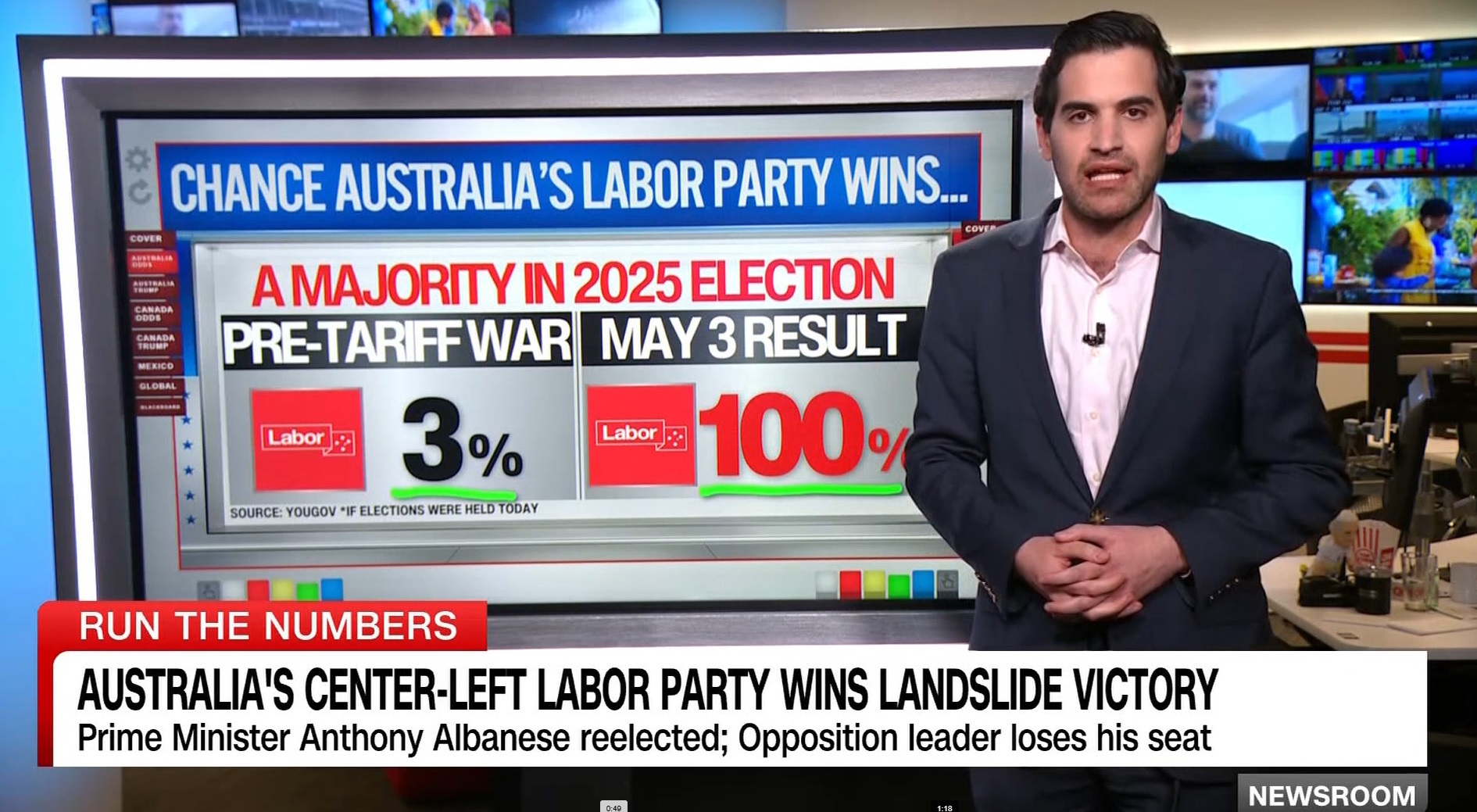

The damning figure that showed Trump's hands were all over this result

The damning figure that showed Trump's hands were all over this result

Five people survive nearly two days in alligator-riddled swamp

Five people survive nearly two days in alligator-riddled swamp

Pakistan test fires ballistic missile as tensions with India spike

Pakistan test fires ballistic missile as tensions with India spike

Trump draws criticism with AI image of himself as the pope

Trump draws criticism with AI image of himself as the pope

Albanese celebrates victory with coffee

Albanese celebrates victory with coffee

Who is Ali France, the Labor MP who conquered Peter Dutton?

Who is Ali France, the Labor MP who conquered Peter Dutton?

How each of the key seats voted

How each of the key seats voted

Have your say on the big issues

Have your say on the big issues

How Nine is farewelling ousted MPs this election

How Nine is farewelling ousted MPs this election

The gruelling 100,000km journey to the election

The gruelling 100,000km journey to the election

Where to get your democracy sausage while casting your vote

Where to get your democracy sausage while casting your vote

What they sell used to be 'taboo' but business is booming for women like Scarlett

What they sell used to be 'taboo' but business is booming for women like Scarlett

Albanese and Dutton make their final 1-minute pitches to voters

Albanese and Dutton make their final 1-minute pitches to voters

Prince Harry loses appeal to restore government-funded security detail

Prince Harry loses appeal to restore government-funded security detail

Mushroom cook 'aggressive' to in-laws before lunch, court hears

Mushroom cook 'aggressive' to in-laws before lunch, court hears