First-quarter growth was slowed by a surge in imports as companies in the US tried to bring in foreign goods before Trump imposed massive tariffs.

The US economy shrank at a 0.3 per cent annual pace from January through March, the first drop in three years, as US President Donald Trump's trade wars disrupted business.

First-quarter growth was slowed by a surge in imports as companies in the US tried to bring in foreign goods before Trump imposed massive tariffs.

The January-March drop in gross domestic product — the nation's output of goods and services — was down from a 2.4 per cent gain in the last three months of 2024. Imports grew at a 41 per cent pace, the fastest since 2020, and shaved 5 percentage points off first-quarter growth.

READ MORE: Mushroom cook pretended to be suffering like guests, court told

READ MORE: Ex-reality TV stars charged with serious child offences

Consumer spending also slowed sharply — 1.8 per cent growth from 4 per cent in October-December last year. Federal government spending plunged 5.1 per cent in the first quarter.

Forecasters surveyed by the data firm FactSet had, on average, expected the economy to eke out 0.8 per cent growth in the first quarter, but many expected GDP to fall.

Financial markets sank on the report. The Dow Jones tumbled 400 points at the opening bell shortly after the GDP numbers were released. The S&P 500 dropped 1.5 per cent and the Nasdaq composite fell 2 per cent.

But business investment rose at a 21.9 per cent clip as companies poured money into equipment.

And a category within the GDP data that measures the economy's underlying strength rose at a healthy 3 per cent annual rate from January through March, up from 2.9 per cent in the fourth quarter of 2024.

This category includes consumer spending and private investment but excludes volatile items like exports, inventories and government spending.

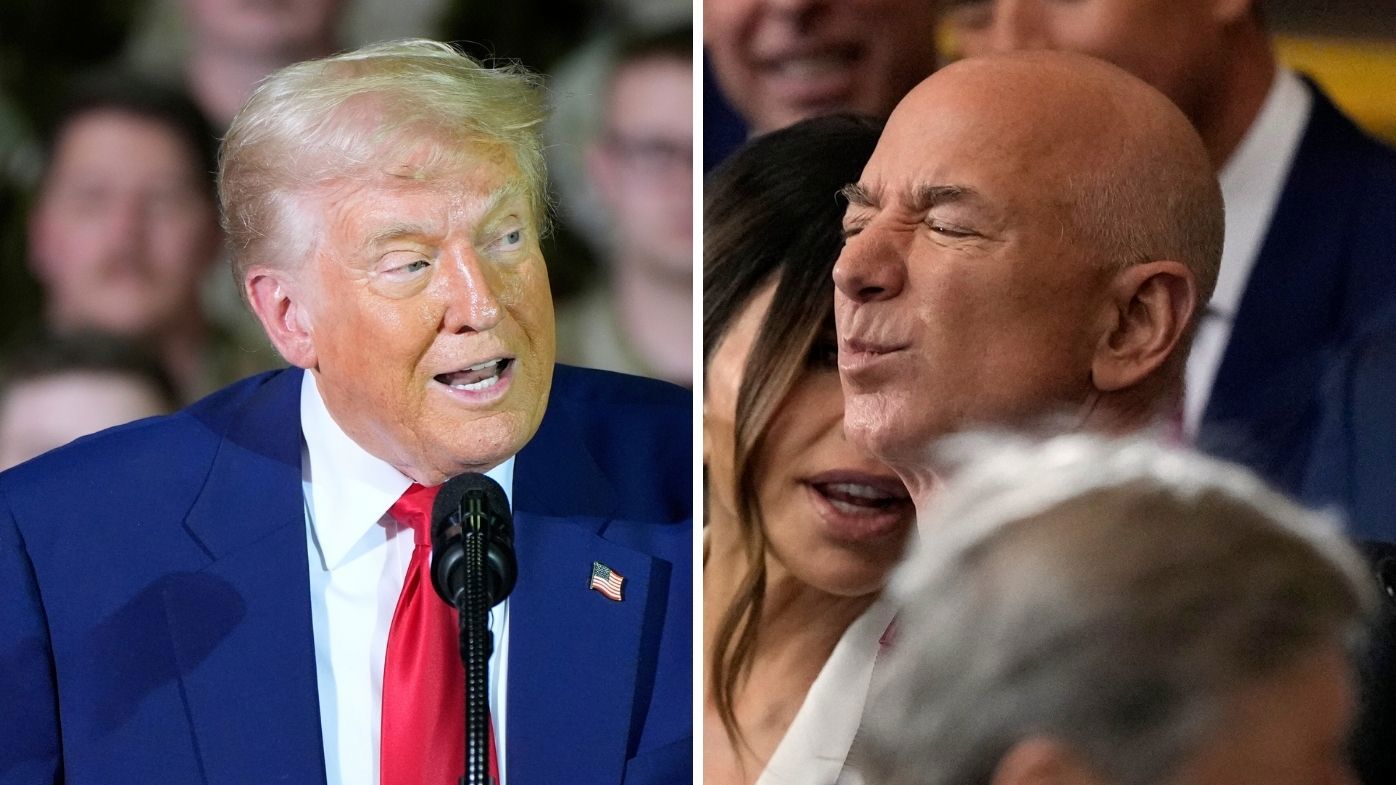

Trump took to his social media platform Truth Social to blame his predecessor Joe Biden for the figures, saying he "didn't take over until January 20th".

"Tariffs will soon start kicking in, and companies are starting to move into the USA in record numbers," he said.

"Our Country will boom, but we have to get rid of the Biden 'Overhang.'

"This will take a while, has NOTHING TO DO WITH TARIFFS, only that he left us with bad numbers, but when the boom begins, it will be like no other. BE PATIENT!!!"

The surge in imports — the fastest since 1972 outside COVID-19 economic disruptions — is likely to reverse in the second quarter, removing a weight on GDP.

For that reason, Paul Ashworth of Capital Economics forecasts that April-June growth will rebound to a 2 per cent gain.

READ MORE: Man drives onto jetty and is blocked from leaving

But many economists say that Trump's massive import taxes — the erratic way he's rolled them out — will hurt growth in the second half of the year and that recession risks are rising.

Wednesday's report also showed an increase in prices that is likely to worry the Federal Reserve which is still trying to cool inflation after a severe pandemic run-up.

The Fed's favoured inflation gauge – the personal consumption expenditures, or PCE, price index – rose at an annual rate of 3.6 per cent, up from 2.4 per cent in the fourth quarter. Excluding volatile food and energy prices, so-called core PC inflation registered 3.5 per cent, compared with 2.6 per cent from October-December. The central bank wants to see inflation at 2 per cent .

The first-quarter GDP numbers "highlight the bind that the Federal Reserve is in," Ryan Sweet of Oxford Economics wrote in a commentary.

The Fed must weigh whether to cut interest rates to support economic growth or leave rates high because of elevated inflation.

"The economy was essentially stagnant in the first three months of the year while growth in headline and core inflation accelerated, fanning concerns of stagflation.''

Trump inherited a solid economy that had grown steadily despite high interest rates imposed by the Federal Reserve to fight inflation.

His erratic trade policies — including 145 per cent tariffs on China — have paralysed businesses and threatened to raise prices and hurt consumers.

There is potential evidence emerging that the solid job market, a pilar of the US economy during the pandemic recession, may be weakening.

On Wednesday, payroll provider ADP showed that companies added just 62,000 jobs in April, about half of what was expected, and down from 147,000 in March. That could be a signal that businesses may be taking a more cautious approach to hiring amid uncertainty over tariffs. Still, the ADP figures often diverge from the government's jobs reports.

Employers in the education and health, information technology, and business and professional services industries all cut jobs. Business and professional services include sectors such as engineering, accounting and advertising.

"Unease is the word of the day," said Nela Richardson, chief economist at ADP.

"It can be difficult to make hiring decisions in such an environment."

DOWNLOAD THE 9NEWS APP: Stay across all the latest in breaking news, sport, politics and the weather via our news app and get notifications sent straight to your smartphone. Available on the Apple App Store and Google Play.

Mushroom cook's 'lies, panic' revealed in murders trial

Mushroom cook's 'lies, panic' revealed in murders trial

Ukraine says it's ready to sign key rare-minerals deal sought by US

Ukraine says it's ready to sign key rare-minerals deal sought by US

Former MKR couple revealed as TV identities charged with serious offences against children

Former MKR couple revealed as TV identities charged with serious offences against children

Stolen $8000 Pokémon card recovered but assault mystery remains

Stolen $8000 Pokémon card recovered but assault mystery remains

Liberal Party escalates legal stoush after campaign signs taken from pre-poll station

Liberal Party escalates legal stoush after campaign signs taken from pre-poll station

Grim discovery after raging inferno destroys Queensland backpacker hostel

Grim discovery after raging inferno destroys Queensland backpacker hostel

'Pretty scary': Man drives Jeep off jetty in tense police standoff

'Pretty scary': Man drives Jeep off jetty in tense police standoff

Second baker comes forward with plagiarism claims against TikToker

Second baker comes forward with plagiarism claims against TikToker

Where to get your democracy sausage this election day

Where to get your democracy sausage this election day

Paramedic denies giving cop fiery spray at Bondi Junction stabbing scene

Paramedic denies giving cop fiery spray at Bondi Junction stabbing scene

Leaders enter final leg of campaign on election trail

Leaders enter final leg of campaign on election trail

Tougher rules for Mount Everest climbers aim to curb 'death zone' hold-ups

Tougher rules for Mount Everest climbers aim to curb 'death zone' hold-ups

Kristy almost lost her life to DV. Three women and an iron will saved her

Kristy almost lost her life to DV. Three women and an iron will saved her

Earth's next celestial event set to reach its peak early next week

Earth's next celestial event set to reach its peak early next week

China tells Trump: 'We won't 'kneel down' on tariffs

China tells Trump: 'We won't 'kneel down' on tariffs

Billionaire warns it's 'too late' to escape damage from Trump's tariffs

Billionaire warns it's 'too late' to escape damage from Trump's tariffs

'Pissed' Trump calls Amazon boss over 'tariff charge'

'Pissed' Trump calls Amazon boss over 'tariff charge'

Killer finally 'sorry' for stabbing ex 78 times

Killer finally 'sorry' for stabbing ex 78 times