Perpetrators are taking advantage of the tax system with a little-known form of economic abuse known as "coerced directorships".

A sinister tax loophole which has left thousands of vulnerable Australians with secret debts could soon be closed by the federal government.

Perpetrators are taking advantage of the tax system with a little-known form of economic abuse known as "coerced directorships" – and it can cost people millions of dollars in fines.

Coerced directorships are a complicated type of financial abuse and typically involve abusive partners forcing or convincing victim-survivors to become a co-director or sole director of a business that they control.

READ MORE: French traveller stuck in Malaysia while trying to make it Australia

Do you have a story? Contact reporter April Glover at april.glover@nine.com.au

Sometimes, it even happens fraudulently without the victim's knowledge.

It can lead to tax debts that quietly accumulate over years, hefty fines or liability for "corporate misconduct".

According to senior lecturer at the Department of Business Law and Taxation at Monash University, Vivien Chen, the impact of this economic abuse is "largely hidden" in Australia.

Chen said abusers have been known to take "control of a business run by the victim survivor and [sabotage] the business or [siphon] off its assets".

"Economic abuse through business debts can occur after separation or divorce and victim-survivors have told of being pressured to sign documents while unaware of their legal consequences amidst threats by the perpetrator to cut off financial support to them and their children," Chen said.

"The perpetrator takes the funds and the benefit of those contracts, at times resigning as co-director, leaving the victim survivor with the debt.

"In the words of one victim survivor, 'He had disappeared, so all the creditors were chasing me for the debts from the business – they couldn't find him'."

Chen said she knew of no studies or research on this form of economic abuse.

Australian women are particularly vulnerable to it due to the sheer volume of family-owned businesses in the country.

Victims now also risk up to $1.375 million in fines due to recent corporate law reforms, Chen said.

Chen and the Economic Abuse Reference Group (EARG) have jointly called for sweeping reforms to stop perpetrators in their tracks.

Among the proposed changes are an amendment to the Corporations Act 2001 to include family violence as a legitimate reason for absence from management and an amendment to the Taxation Administration Act 1953 to include family violence as a defence from liability.

READ MORE: Why thousands of Australians are buying and selling snack vending machines

READ MORE: Professor flooded with death threats over what he wants banned from Queensland

Assistant Treasurer Daniel Mulino today said the government aimed to crack down on the "dodgy use of directorships by perpetrators".

"Too many people have been left with liabilities they never agreed to and penalties for decisions they never made," Mulino said.

"Our goal is to build a system that protects people from exploitation and ensures perpetrators cannot hide behind corporate structure."

A newly released consultation paper has delivered some options for how legislation may stop financial abusers exploiting Australia's tax system.

This includes strengthening the Australian Securities and Investments Commission's (ASIC) powers to remove non-consenting company directors and making it easier for victims to engage with the Australian Tax Office (ATO).

The report also suggests stronger criminal consequences for fraudulent or coerced director appointments.

Submissions to the consultation will close on December 24.

Is economic abuse a crime in Australia?

In Australia, economic abuse or financial abuse can be considered a crime it if involves fraud, theft or coercive control.

Every Australian state and territory also recognises that economic abuse is a type of domestic violence.

And every state and territory has a form of a domestic violence order which is designed to protect victims.

According to the Centre for Women's Economic Safety, these orders aren't often used to protect money or assets but you may be able to request this if necessary.

Currently, there is no legislation that specifically outlaws "coerced directorships".

Support is available from the National Sexual Assault, Domestic and Family Violence Counselling Service at 1800RESPECT (1800 737 732).

Teen charged after allegedly being duped into importing 16kg of meth into Australia

Teen charged after allegedly being duped into importing 16kg of meth into Australia

Accused Easey Street killer to stand trial on two counts of murder

Accused Easey Street killer to stand trial on two counts of murder

MP files court action challenging consitutionality of social media ban

MP files court action challenging consitutionality of social media ban

Vandals blamed for Optus outage that hit more than 14,500 customers

Vandals blamed for Optus outage that hit more than 14,500 customers

WA premier calls on councillor who tried to expense a drink at strip club to reconsider position

WA premier calls on councillor who tried to expense a drink at strip club to reconsider position

These dangerous texts are flooding millions of Aussies' phones

These dangerous texts are flooding millions of Aussies' phones

Second teen charged over alleged stabbing murder of 17-year-old refused bail

Second teen charged over alleged stabbing murder of 17-year-old refused bail

FBI seeks interviews with Democrats who urged US troops to defy illegal orders

FBI seeks interviews with Democrats who urged US troops to defy illegal orders

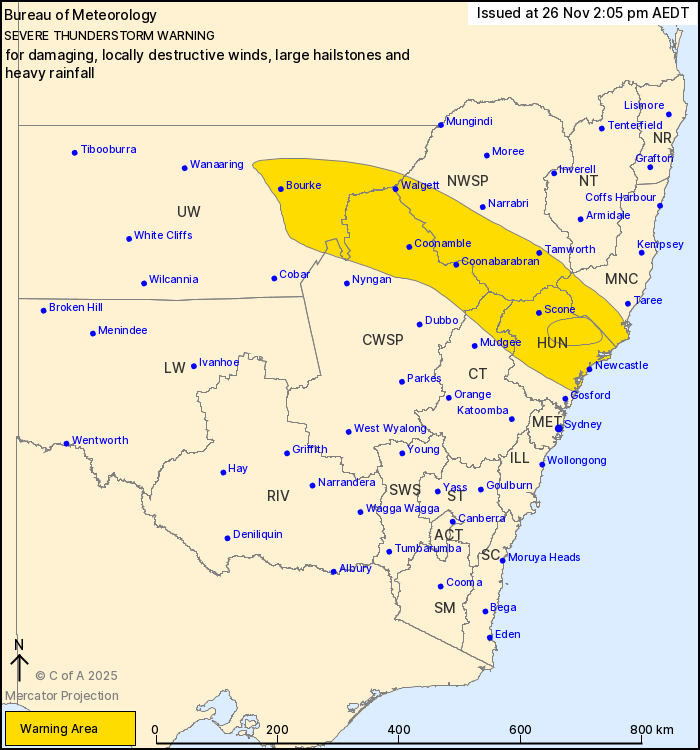

Severe thunderstorms across NSW cause public transport delays

Severe thunderstorms across NSW cause public transport delays

Gramma, a 141-year-old Galapagos tortoise, dies in US

Gramma, a 141-year-old Galapagos tortoise, dies in US

Delivery driver's scooter stolen in brazen daylight street robbery

Delivery driver's scooter stolen in brazen daylight street robbery

Elderly man rescued from Victorian river after mobility scooter fail

Elderly man rescued from Victorian river after mobility scooter fail

Rock-star fame as bad for you as smoking, study claims

Rock-star fame as bad for you as smoking, study claims

'Detention': UK PM leads class in banned meme dance

'Detention': UK PM leads class in banned meme dance

Councillor apologises for trying to bill ratepayers for strip club beer

Councillor apologises for trying to bill ratepayers for strip club beer

'Big, fat slob': Feathers fly as Trump pardons Thanksgiving turkeys

'Big, fat slob': Feathers fly as Trump pardons Thanksgiving turkeys