Young Australians could find themselves a lot worse off in retirement simply because they showed a lack of interest in their superannuation funds, new research suggests.

Young Australians could find themselves around $128,000 worse off in retirement, simply because they showed a lack of interest in their superannuation funds, new research suggests.

The Super Members Council is urging young Australians to check their super more often after new research revealed more than a third either look at their super or only check it once a year.

The survey of more than 1300 Australians by research house Ideally found more than one in four Australians (26 percent) couldn't name their own super fund. The issue is slightly more prevalent for young Aussies, with 28 percent unaware of who is managing their retirement savings.

READ MORE: More than a illion Aussies on verge of getting superannuation boost

The Council modelled the marked financial impact of this lack of engagement and found that paying just 0.1 percent more in fees could make someone $14,000 worse off at retirement. For those paying 1 percent more in fees, the loss balloons to a staggering $128,000.

Super Members Council CEO Misha Schubert said Australia's retirement system was the envy of the world, but more needed to be done to make young Australians aware of how to make the most of it.

"Too many Australians risk sleepwalking into retirement with less money than they should have because they haven't felt confident to engage with their super," Schubert said.

"Small differences in super can add up to life-changing sums over time. That's why staying engaged with your super from when you start working until you retire is so important."

The rising cost of 'setting and forgetting'

The warnings come as Australian superannuation balances hit record highs. According to recent data from the Association of Superannuation Funds of Australia (ASFA), the average super balance has climbed to $172,834. For those nearing retirement (aged 65-69), the average balance has reached $420,934.

Despite these growing figures, 33 percent of young Australians say super doesn't "feel like their money" because retirement feels so far away.

The Super Members Council said the "best yardstick" for performance was "net benefit" - the total investment returns left over after all fees and insurance costs are deducted.

Previous research found that young Australians who understand their super are six times more likely to take action to improve their savings.

Simple steps to boost your balance

With the Super Guarantee rising to 12%, balances are set to grow even faster. The Council suggests several immediate steps to ensure young workers aren't leaving money on the table:

Check you are being paid: Unpaid super affects one in four workers, costing 3.3 million Australians almost $6 billion a year. Use your fund's app to verify employer contributions.

Consolidate accounts: Use the Australian Taxation Office (ATO) online tools to find lost super and merge accounts to avoid paying multiple sets of fees.

Compare performance: Use the ATO's MySuper comparison tool to see if your fund is a top performer.

Small contributions, big impact: Modelling shows an average 30-year-old who salary sacrifices just $20 a week could have $67,000 more at retirement, while also benefiting from tax savings today.

The information provided on this website is general in nature only and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information on this website you should consider the appropriateness of the information having regard to your objectives, financial situation and needs.

NEVER MISS A STORY: Get your breaking news and exclusive stories first by following us across all platforms.

- Download the 9NEWS App here via Apple and Google Play

- Make 9News your preferred source on Google by ticking this box here

- Sign up to our breaking newsletter here

'As good as it gets': Bank's bleak warning to every Australian

'As good as it gets': Bank's bleak warning to every Australian

50,000 Aussies just got a new job - but there could be an unwelcome flow-on effect

50,000 Aussies just got a new job - but there could be an unwelcome flow-on effect

Trump warns UK against giving away key military base

Trump warns UK against giving away key military base

Man charged over alleged death threats to Treasurer Jim Chalmers

Man charged over alleged death threats to Treasurer Jim Chalmers

Billionaire says he was duped by 'world-class con man' Jeffrey Epstein

Billionaire says he was duped by 'world-class con man' Jeffrey Epstein

Motorway reopens south of Sydney after truck crash spilled molasses

Motorway reopens south of Sydney after truck crash spilled molasses

Public servant charged over alleged $5 million NDIS fraud

Public servant charged over alleged $5 million NDIS fraud

'ISIS bride' banned from returning, minister confirms passports

'ISIS bride' banned from returning, minister confirms passports

Surprise benefit households get from stronger Aussie dollar

Surprise benefit households get from stronger Aussie dollar

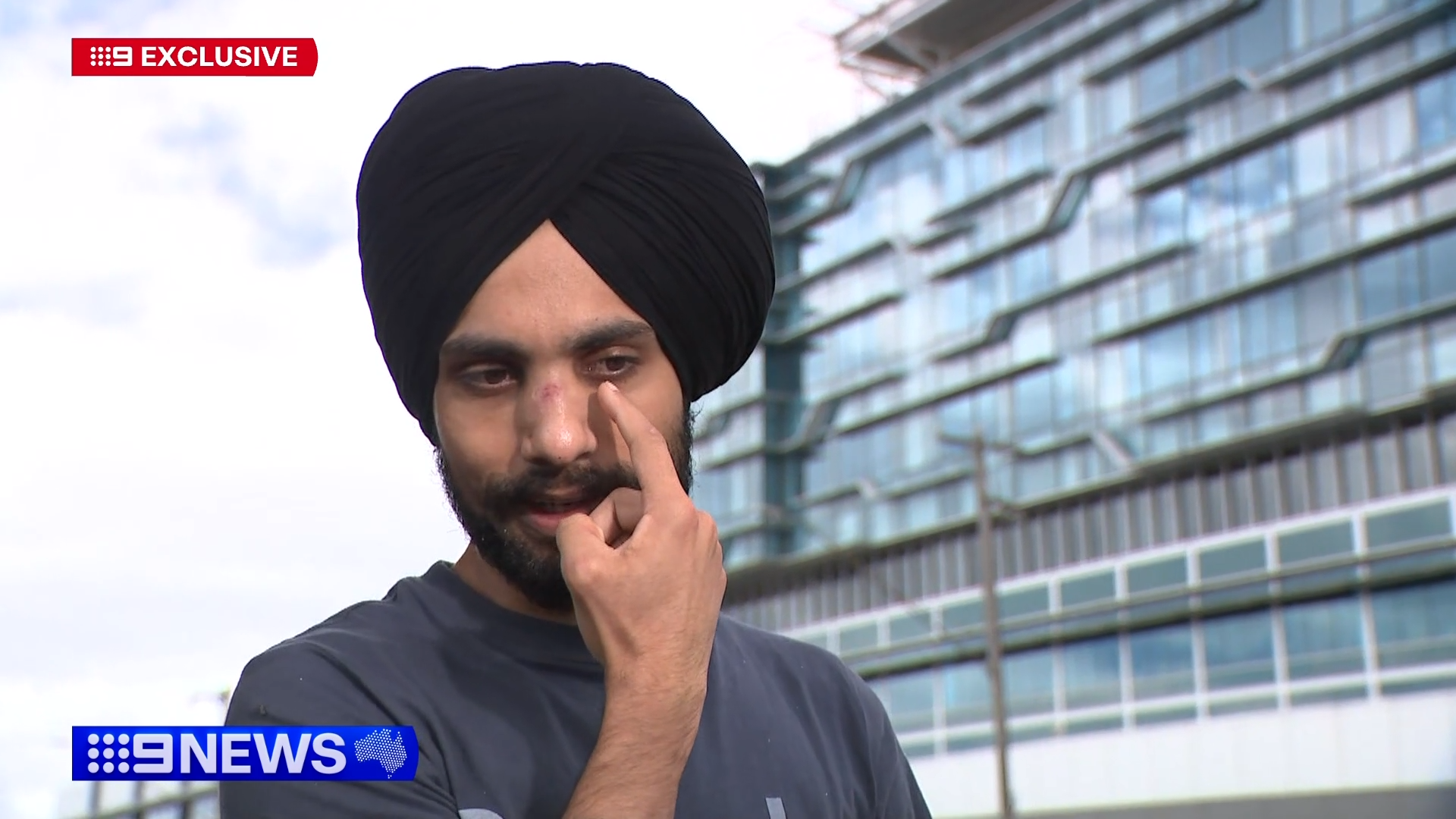

Nurse assaulted in alleged racist attack at Geelong gym

Nurse assaulted in alleged racist attack at Geelong gym

Sydney was the hottest place in Australia before a sudden downpour

Sydney was the hottest place in Australia before a sudden downpour

NSW's new public holiday to bring financial pressures to small businesses

NSW's new public holiday to bring financial pressures to small businesses

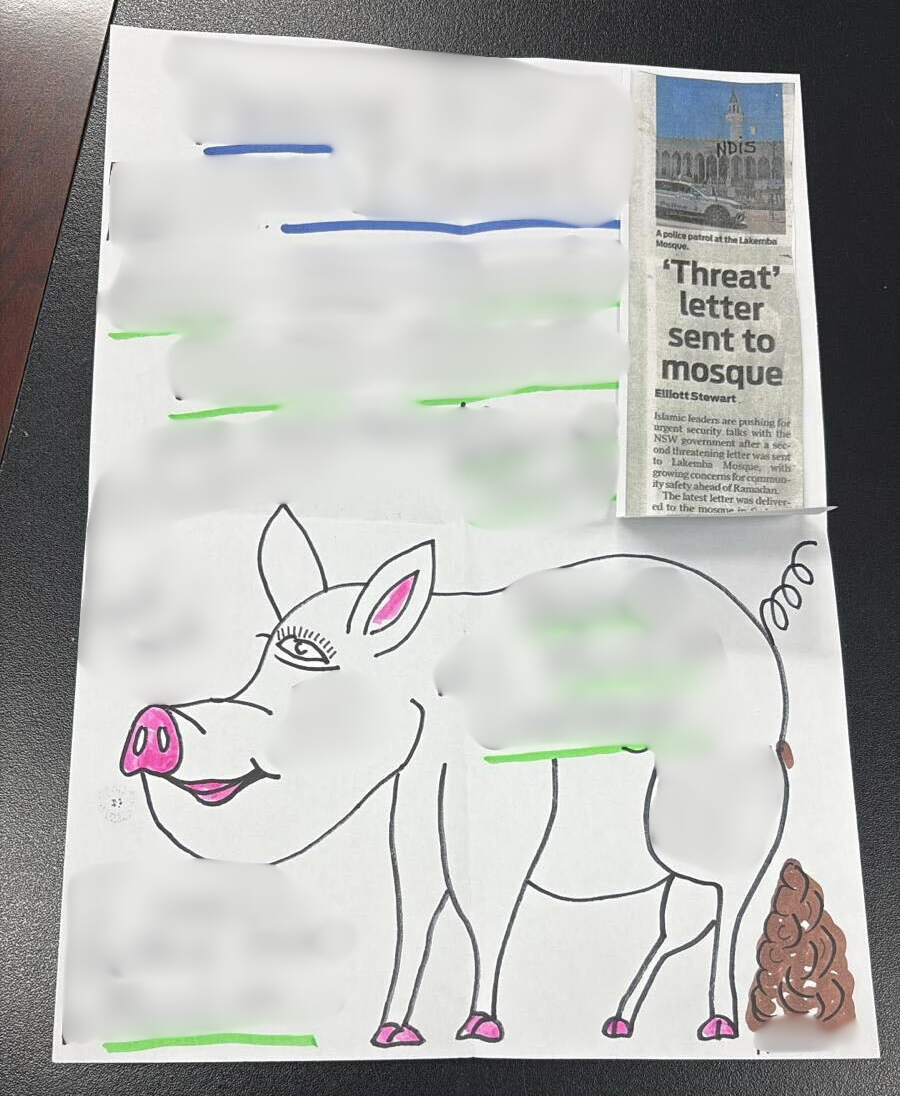

Families 'scared to bring children to prayers' as mosque receives third threatening letter

Families 'scared to bring children to prayers' as mosque receives third threatening letter

One in three parents 'distressed' about vaccinating their kids

One in three parents 'distressed' about vaccinating their kids