Family financial help is creating a two-tier housing market of the haves and have-nots, experts fear.

Ahead of tomorrow's interest rates decision by the Reserve Bank of Australia, the impact of the bank of mum and dad on home prices continues to stir debate.

The cash rate is hotly tipped to remain on hold at 3.60 per cent when the RBA hands down its decision at 2.30pm tomorrow, leaving hard-pressed mortgage holders disappointed.

The forecast was supported by a survey of economic experts by comparison site Finder that found 30 from 35 expected no change.

READ MORE: Struggling Aussies won't get another rate cut after scorching inflation data, major bank predicts

But economists and analysts showed far less unity when quizzed about the effects of parents giving their children financial support to gain a foothold in the housing market.

New Finder research – based on a survey of 1006 first-home buyers – revealed 17 per cent relied on the financial help of parents or family to save their deposit, up from 11 in 2022.

That's the equivalent of almost 20,000 first home buyers a year who were lucky enough to receive financial help from their parents.

Finder head of consumer research Graham Cooke said without it, property ownership would be out of reach for many young people.

"Those who can lean on mum and dad are typically entering the market not just sooner, but in a much stronger position," he said.

But while it's giving some lucky few a leg up, nearly one in three experts canvassed by Finder believe it is also distorting the housing market.

Among them are Michael Yardney, from Metropole Property Strategists, who thinks a twin-track housing market is evolving.

"This is creating a two-tier market of the haves and have-nots, families with property equity already and others," he said.

On the other hand, Tim Reardon from the Housing Industry Association said family support is a natural part of a well functioning market.

"[Parents] are not a distortion, they are correcting the market distortion created by the severe lending restrictions imposed on first home buyers," he said.

There was also concern about the impact of the government's First Home Guarantee Scheme, which will allow all first home buyers to purchase a home with only a 5 per cent deposit instead of the usual 20 per cent.

From the 26 experts canvassed, 65 per cent think it will encourage first home buyers to take on more debt than they should.

DOWNLOAD THE 9NEWS APP: Stay across all the latest in breaking news, sport, politics and the weather via our news app and get notifications sent straight to your smartphone. Available on the Apple App Store and Google Play.

The 4-word slogan that scares Aussie cyber experts

The 4-word slogan that scares Aussie cyber experts

Erin Patterson granted leave to appeal guilty verdicts

Erin Patterson granted leave to appeal guilty verdicts

'Mistakes made': Optus bosses admit failures in fatal triple-zero outage

'Mistakes made': Optus bosses admit failures in fatal triple-zero outage

Road rage dispute that led to man's death either murder or self-defence, court hears

Road rage dispute that led to man's death either murder or self-defence, court hears

Guilty verdict after body stuffed into tree and burned in 'cold-blooded' murder

Guilty verdict after body stuffed into tree and burned in 'cold-blooded' murder

Only third of Aussies are wearing sunscreen most days, in line with guidelines

Only third of Aussies are wearing sunscreen most days, in line with guidelines

Sole survivor of fatal NSW mine explosion faced with permanent hearing loss

Sole survivor of fatal NSW mine explosion faced with permanent hearing loss

Two dogs seized as man fights for life after being mauled inside Sydney unit

Two dogs seized as man fights for life after being mauled inside Sydney unit

Orca pod seen hunting sharks with special 'paralysis' move

Orca pod seen hunting sharks with special 'paralysis' move

Kookaburra lands on bride's head during wedding ceremony

Kookaburra lands on bride's head during wedding ceremony

Australian Mint brings out limited edition coin

Australian Mint brings out limited edition coin

A stunning celestial event kicks off this week. Here's how to see it

A stunning celestial event kicks off this week. Here's how to see it

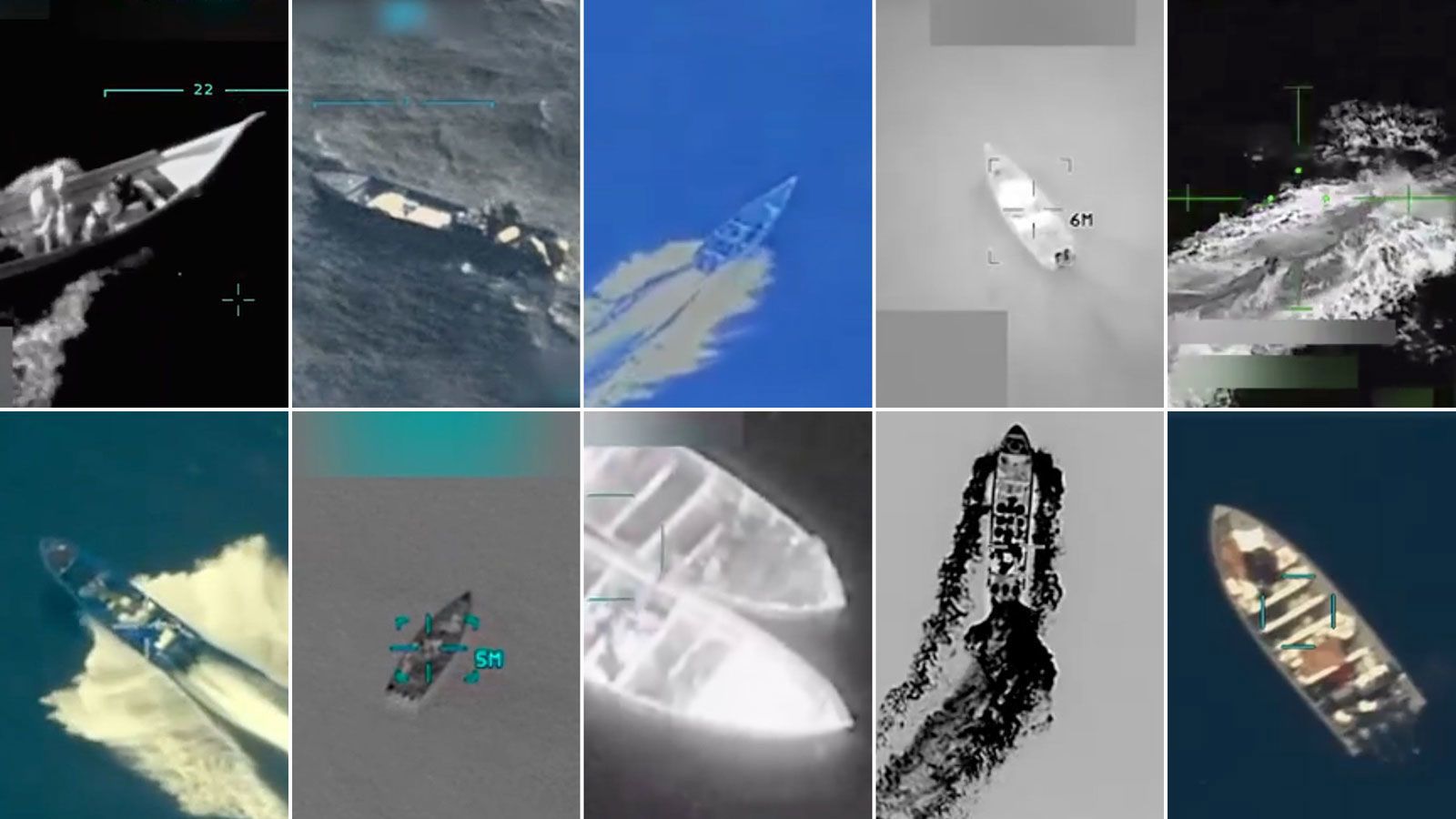

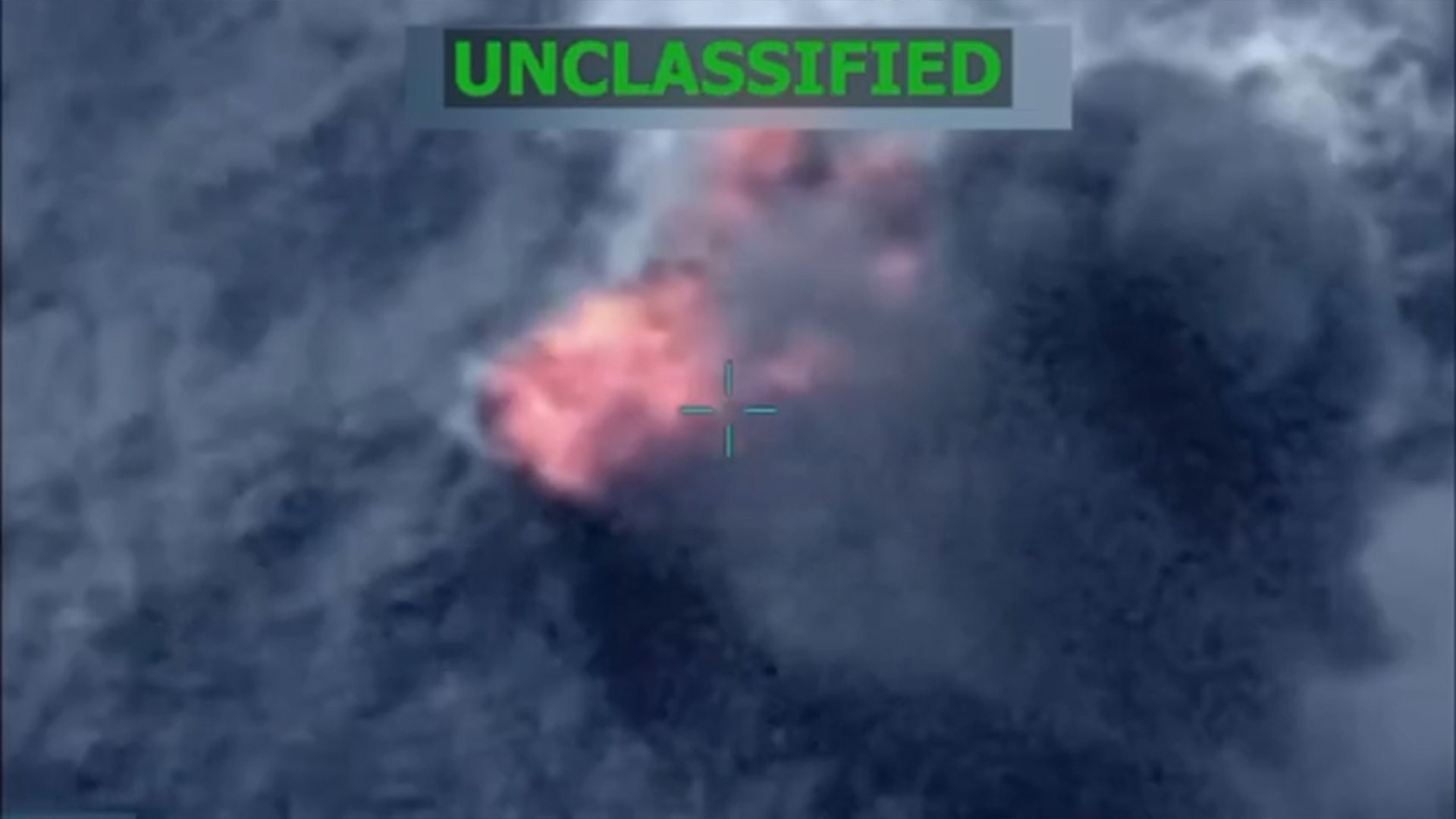

A timeline of US strikes on boats that have killed 64

A timeline of US strikes on boats that have killed 64

Everything you need to know about the 2026 Sydney Gay and Lesbian Mardi Gras

Everything you need to know about the 2026 Sydney Gay and Lesbian Mardi Gras

Three in four Aussies share the same fear - and it could cost them hundreds

Three in four Aussies share the same fear - and it could cost them hundreds

Powerful earthquake shakes northern Afghanistan months after deadly quakes

Powerful earthquake shakes northern Afghanistan months after deadly quakes

Trump doesn't need approval alleged drug boat strikes: Justice Department

Trump doesn't need approval alleged drug boat strikes: Justice Department

'Heroic' staffer fighting for his life after saving people in UK train stabbing

'Heroic' staffer fighting for his life after saving people in UK train stabbing

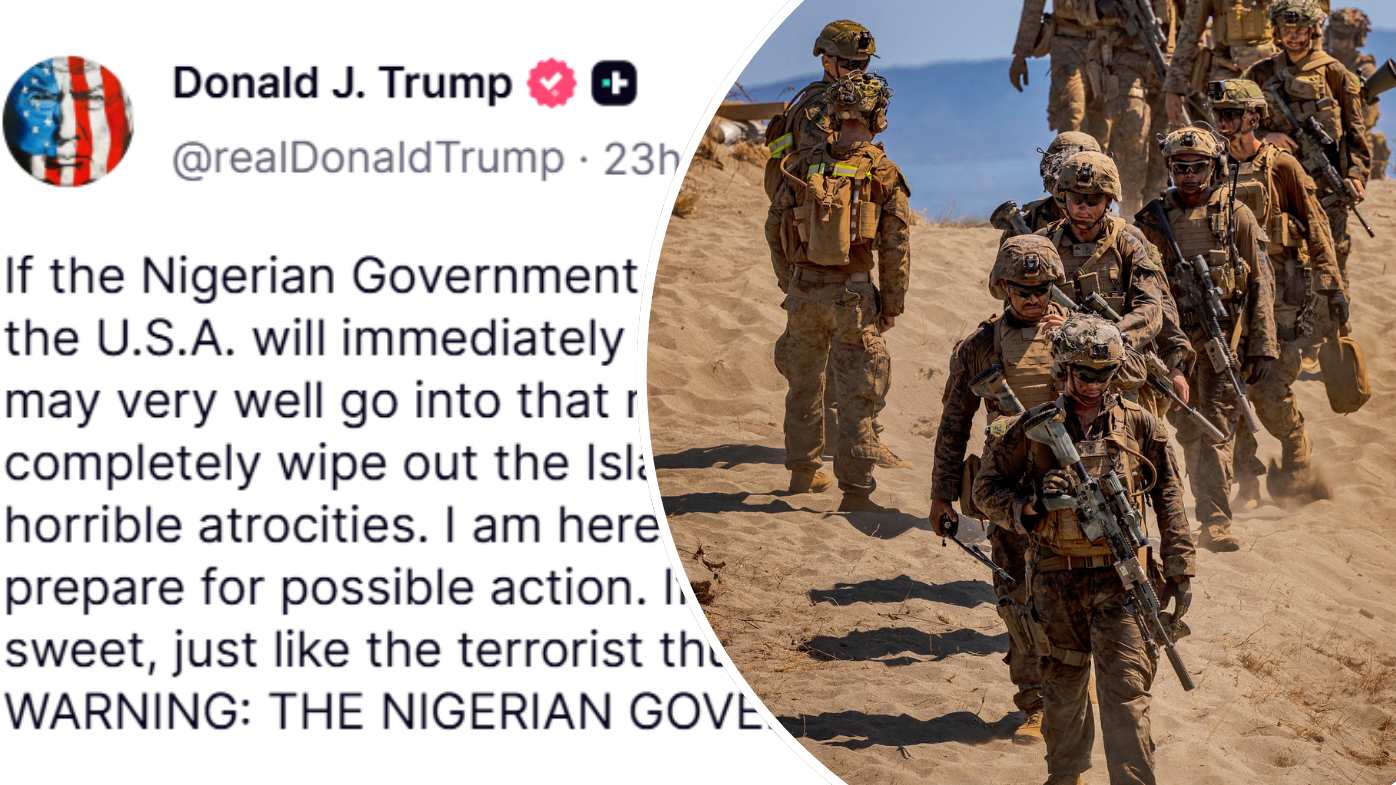

Pentagon preparing war plans after Trump threatens nation online

Pentagon preparing war plans after Trump threatens nation online