A typical new retiree could lose out on as much as $136,000 over the course of their retirement.

A typical new retiree could lose out on as much as $136,000 over the course of their retirement due to the bewildering complexity of Australia's superannuation system, according to a new report.

The staggering figure—equivalent to $6,500 a year—was highlighted in modelling released today by the Super Members Council, which found the system's "daunting complexity" is stopping everyday Australians from achieving their full financial potential in their post-work years.

Australia is on the cusp of a "silver tsunami," with 2.8 million Australians racing towards retirement in the coming decade. This influx will effectively double the number of Australians retiring each year, jumping from 150,000 to 300,000.

READ MORE: Aussies won't get another rate cut after inflation data, bank predicts

The amount of money in super held by these retirees will almost double, too, soaring from around $750 billion over the past decade to almost $1.5 trillion over the next.

In its report, the Super Members points to the current complexity and rigidity of the system as a significant barrier to a simple, seamless transition into retirement for many.

One critical finding reveals that about 700,000 Australians over 65 who aren't working full-time still have their super sitting in taxed savings-phase super accounts, which drastically lowers their disposable income in retirement.

The report calls for a series of urgent, short-term reforms to prepare the super system, including the need to:

Expand access to simple, affordable financial advice and digital tools.

Enable safe and effective data sharing with Government to allow funds to optimise incomes and offer retirement income dashboards.

Support Smart Retirement Pathways and suggest the best retirement income solution for members.

Fix issues that lead to dual super accounts for retirees.

For the longer term, the council proposes bolder directions, such as simplifying a transition to tax-free income—including considering automatically removing tax from accounts at age 65 for eligible members—and rethinking minimum drawdown requirements for poorer retirees. It also recommends strengthening consumer protection by applying a quality filter on all retirement products.

Dispelling a "persistent myth" that most retirees underspend their super, the report actually shows that drawdowns are typically higher than the minimums required. In 2024–25, approximately 64 per cent of tax-free retirement account holders (two in every three retirees) withdrew above the minimum. This proportion was even higher for those with less than $50,000 in super, at 77 per cent.

"We need to make the shift into retirement so much simpler, easier and more intuitive for everyday Australians," Super Members Council CEO Misha Schubert said.

"This challenge is now incredibly urgent as almost 3 million Australians start to race towards retirement in the coming years."

"Moving to a system of simpler, smarter pathways into retirement would mean every Australian could retire with confidence, knowing they're not missing out on money to pay the bills and enjoy life to the fullest."

The report's findings echo a report by the Grattan Institute, released in January, which found the complexity in Australia's superannuation system was leaving retirees stressed and lacking the confidence to spend their super savings.

Sign up here to receive our daily newsletters and breaking news alerts, sent straight to your inbox.

Prince Andrew to lose 'prince' title, move out of royal lodge

Prince Andrew to lose 'prince' title, move out of royal lodge

Hopes of Melbourne Cup Day rates cut remain a long shot

Hopes of Melbourne Cup Day rates cut remain a long shot

Camper killer Greg Lynn's appeal against guilty verdict to begin

Camper killer Greg Lynn's appeal against guilty verdict to begin

Massively popular protein bars pulled from shelves over branding

Massively popular protein bars pulled from shelves over branding

Sensitive parliamentary documents handed to private company against risk advice

Sensitive parliamentary documents handed to private company against risk advice

Cheers as state legislates historic treaty with First Nations people

Cheers as state legislates historic treaty with First Nations people

Family 'shocked and saddened' by death of cruise ship passenger on Lizard Island

Family 'shocked and saddened' by death of cruise ship passenger on Lizard Island

Baby killer was tired, frustrated before assaulting boy

Baby killer was tired, frustrated before assaulting boy

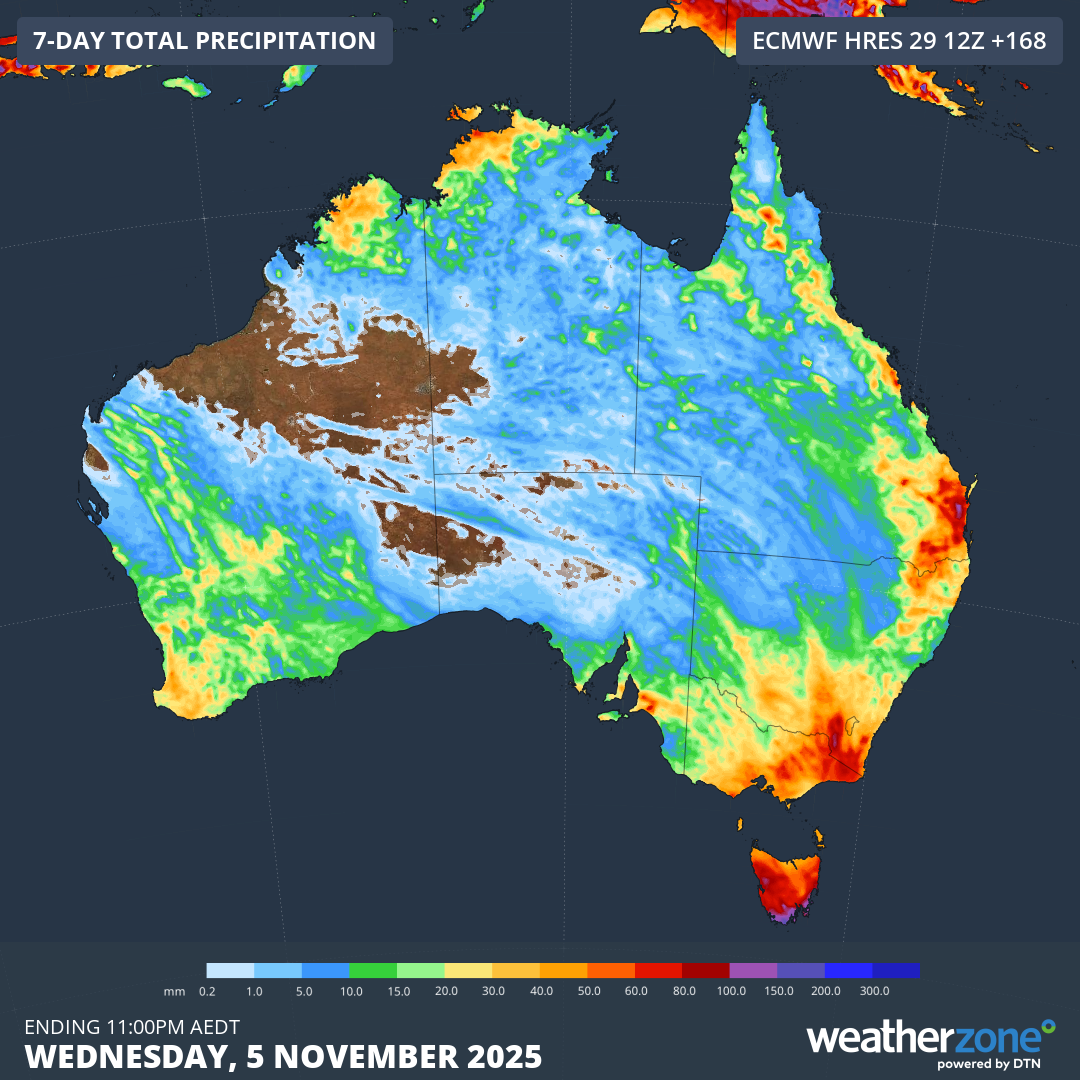

Millions facing storms 'every day' for nearly a week

Millions facing storms 'every day' for nearly a week

Trump slashes refugee intake to 7500. It'll be mostly white South Africans

Trump slashes refugee intake to 7500. It'll be mostly white South Africans

Authorities receive shocking video of person standing on dead whale south of Sydney

Authorities receive shocking video of person standing on dead whale south of Sydney

'12 out of 10': Trump lowers tariffs after successful China meeting

'12 out of 10': Trump lowers tariffs after successful China meeting

'Salacious gossip' or news? Tennis star turned MP to test new privacy law

'Salacious gossip' or news? Tennis star turned MP to test new privacy law

Council introduces cat law with owners facing household limit and $300 fine

Council introduces cat law with owners facing household limit and $300 fine

Australia's richest people under 40 revealed in new list

Australia's richest people under 40 revealed in new list

'Every four hours': Shock stat reveals Australia's illegal gun crisis

'Every four hours': Shock stat reveals Australia's illegal gun crisis

Long arm of the law forgets to reach for his pants

Long arm of the law forgets to reach for his pants

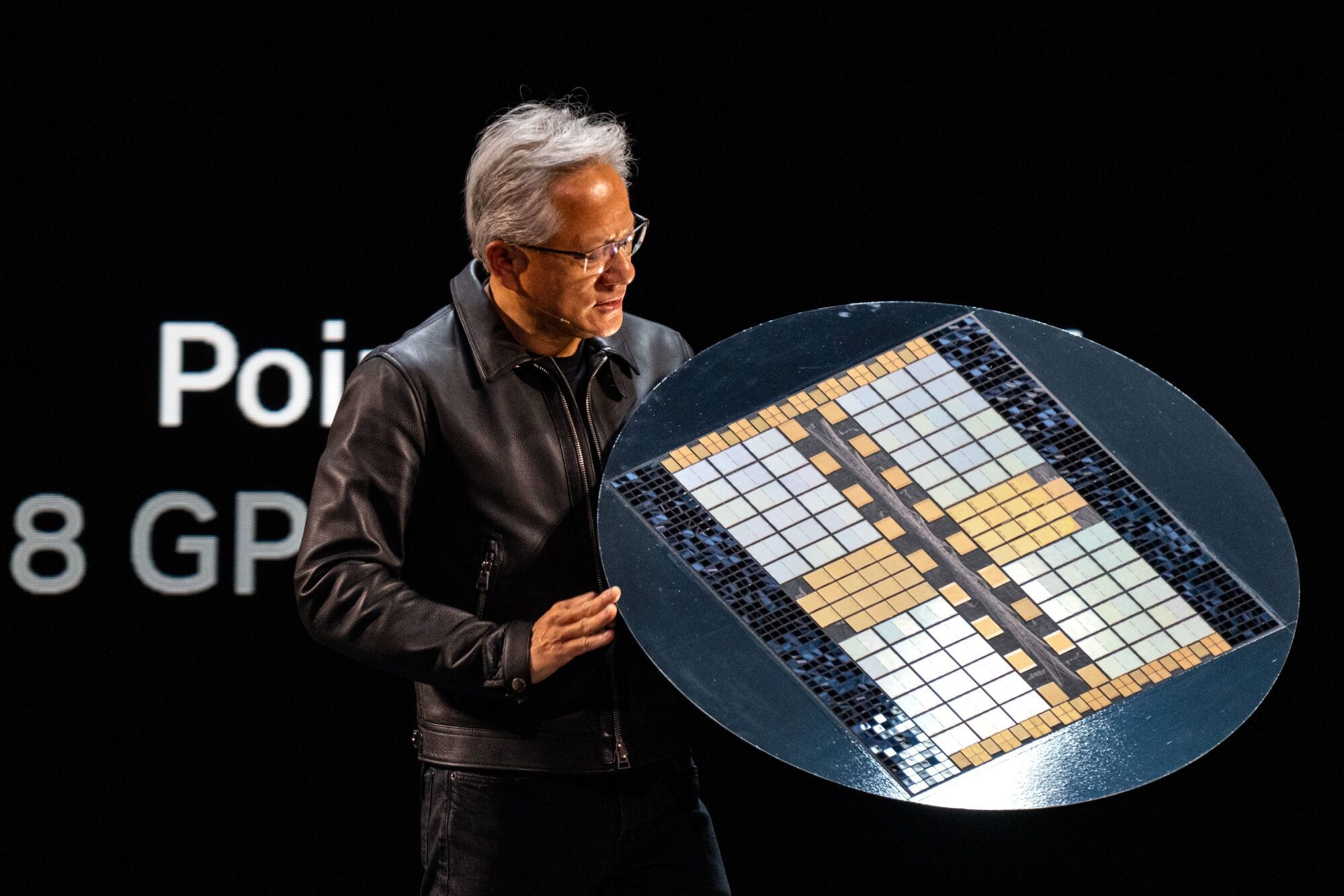

This one company is now worth more than Japan, India and the UK

This one company is now worth more than Japan, India and the UK