From one side of the country to the other, the cost of the great Australian dream has never been higher.

A new capital has joined the ranks of Australian cities where the average house exceeds $1 million, as property prices continue their stubborn climb nationwide.

The median cost of a standalone home in Perth hit $1,003,804 in January, climbing 1.9 per cent from the previous month, according to Cotality's Home Value Index.

It is the fourth Australian city to reach that benchmark, trailing just behind Brisbane and Canberra where median house prices have crept up to $1,149,589 and $1,033,761 respectively.

READ MORE: Nationals leader David Littleproud survives failed leadership spill

It comes amid persistent property price rises nationwide, despite renewed cost of living pressures on the eve of a forecast interest rate hike.

The newly released Home Value Index also shows that it is the most affordable properties - those in the lowest quarter of the price range - where prices are rising fastest, in a trend that risks pushing home ownership ever further out of reach for thousands of Australians.

While Sydney remains by far the most unaffordable city for house ownership, with a median price of $1,598,819, growth has slowed to just 0.3 per cent in January.

Nationally, the value of Australian homes (both houses and apartments) rose by 0.8 per cent in January, according to Cotality's Home Value Index - a slight uptick from 0.6 per cent in December.

Stubbornly high property prices are a fresh blow to prospective home buyers who are bracing for a cut to their borrowing power if the Reserve Bank hikes interest rates tomorrow as forecast.

"Despite the most unaffordable conditions on record in many cities, along with a rebound in cost of living pressures and prospect of a rate hike as early as (tomorrow), we are still seeing a broad-based rise in housing values," Cotality's research director Tim Lawless said.

However, Lawless suggested price rises are likely to ease this year, as demand eased and forecast interest rate hikes limited people's ability to service larger mortgages.

READ MORE: Man, 25, charged with murder over death of newborn baby

The number of homes advertised for sale is currently 19 per cent below where it was at this time last year and 25 per cent below the five-year average.

At the same time, the quarterly number of home sales is one per cent higher than a year ago.

Australia's smaller and mid-sized capitals have recorded the biggest jump in property prices, with Perth, Brisbane and Adelaide prices rising by between 1.2 and 2 per cent.

That compares to an incremental creep of just 0.2 and 0.1 per cent respectively for Sydney and Melbourne.

In the past year, Darwin has seen the steepest property price increases, up by almost a fifth (19.7 per cent).

The second-largest increase is in Perth, where combined house and unit prices have risen by 18.5 per cent annually, making it the third most expensive city to buy a property after Sydney and Brisbane.

Sydney and Melbourne properties are up a comparatively small 6.4 and 5.4 per cent annually.

In worrying news for housing affordability and equality, homes at the most affordable end of the housing market are seeing the largest price hikes.

House values in the lowest quartile rose by 1.3 per cent, compared to just 0.3 per cent rise in the top quartile.

"This trend of stronger growth conditions at lower price points is supported by intense competition for more affordable houses," said Lawless.

"This is where first home buyers, investors and, progressively, mainstream demand is most concentrated."

NEVER MISS A STORY: Get your breaking news and exclusive stories first by following us across all platforms.

- Download the 9NEWS App here via Apple and Google Play

- Make 9News your preferred source on Google by ticking this box here

- Sign up to our breaking newsletter here

Triple murder suspect sighted days after alleged deadly rampage

Triple murder suspect sighted days after alleged deadly rampage

Nationals leader David Littleproud survives failed leadership spill

Nationals leader David Littleproud survives failed leadership spill

Osbournes in tears as A-listers honour Ozzy at Grammys

Osbournes in tears as A-listers honour Ozzy at Grammys

Community rewards Rabbi's selfless act during Bondi terror attack

Community rewards Rabbi's selfless act during Bondi terror attack

Man, 25, charged with murder over death of newborn baby

Man, 25, charged with murder over death of newborn baby

Accused 'Pam the Bird' graffitist to face trial

Accused 'Pam the Bird' graffitist to face trial

'A warning sign': Home buyers' budgets could be cut by thousands overnight

'A warning sign': Home buyers' budgets could be cut by thousands overnight

'Live in the moment': Australian snowboarder killed in chairlift accident

'Live in the moment': Australian snowboarder killed in chairlift accident

Police believe accused cop killer Dezi Freeman could be dead as fresh search begins

Police believe accused cop killer Dezi Freeman could be dead as fresh search begins

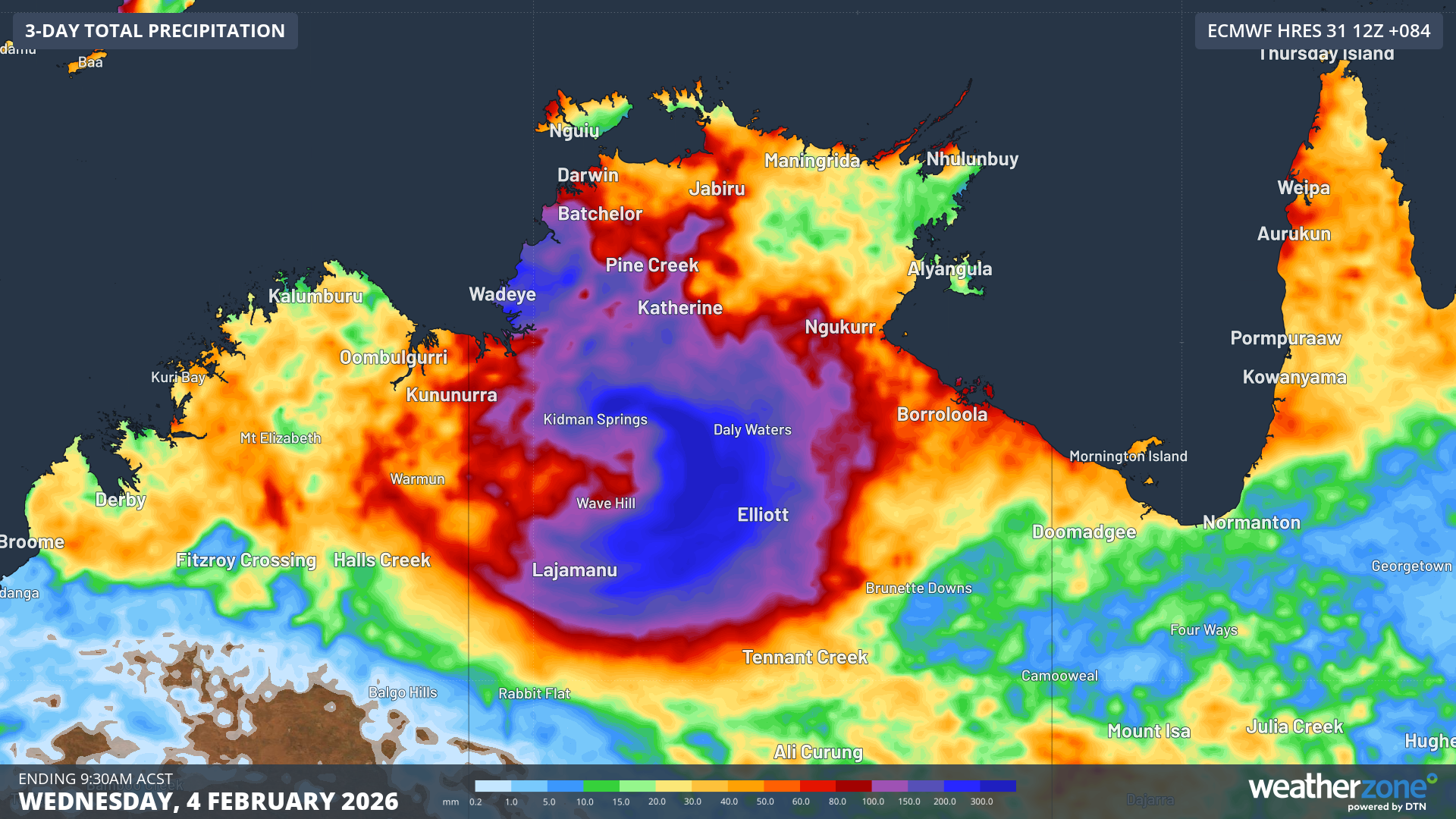

Aussie territory set to cop a drenching this week

Aussie territory set to cop a drenching this week

ICE detained boy, 5. Judge ordered him released with scathing takedown

ICE detained boy, 5. Judge ordered him released with scathing takedown

Parents of Sydney Harbour shark attack victim, 12, join poignant Bondi paddle out

Parents of Sydney Harbour shark attack victim, 12, join poignant Bondi paddle out

'Confusion, anxiety': Expats from one country urged to check citizenship status

'Confusion, anxiety': Expats from one country urged to check citizenship status