NAB will take a $130 million hit this year after an internal review found it had underpaid staff.

NAB will take a $130 million hit this year after an internal review found it had underpaid staff.

The big four bank told investors today that its operating expenses will be 4.5 per cent higher this financial year due to the costs for the review and remediation of payroll issues.

The final cost could be even worse as the bank warned that its "payroll review and remediation is ongoing and total costs remain uncertain".

READ MORE: Crime group 'links' in spotlight after deadly Sydney pub shooting

Some of the issues relate to job sharing, rosters and wage and leave entitlements.

NAB is beginning remediation with staff and a broader review into payroll-related benefits under current and former employee contracts.

The bank could not say how many staff were affected.

NAB group executive of people and culture Sarah White apologised to staff, adding that "paying staff correctly is an absolute priority".

"We are sorry and apologise to our colleagues that this has happened and have commenced remediating those impacted," she said.

NAB's chronic payroll issues were first identified in 2019, with a review finding that the bank incurred $250 million over two years.

READ MORE: Qantas fined $90 million for illegally sacking staff

An ongoing review, as well as new human resources and payroll platforms and the transition of staff to a new enterprise agreement, identified the further issues announced today.

NAB will also work with the Fair Work Ombudsman and the Finance Sector Union.

Finance Sector Union national president Wendy Streets said the money should "never have been taken from workers in the first place".

"At a time when Australians are struggling through the worst cost-of-living crisis in decades, this scale of underpayment is nothing short of systemic wage theft," she said.

"The Finance Sector Union has met with NAB, expressing its disbelief that one of the nation's biggest banks has once again failed to pay its workers correctly."

NAB and the Finance Sector Union will meet again this month, where Streets will be demanding guarantees that workers will never be "ripped off" to this scale again.

READ MORE: Capital set for soaking as another cold front sweeps in

While the bank told investors of the $130 million hit, it simultaneously posted that it made $1.8 billion in cash earnings in the three months to June.

NAB saw a two per cent increase in underlying profit in the third quarter, and a four per cent rise in business and banking lending.

The bank grew its home loans by two per cent.

NAB chief executive Andrew Irvine said the payroll issues were "disappointing and must be fixed", but remained optimistic.

"We remain optimistic about the outlook and are well placed to manage NAB for the long term and deliver sustainable growth and returns for shareholders," he said.

DOWNLOAD THE 9NEWS APP: Stay across all the latest in breaking news, sport, politics and the weather via our news app and get notifications sent straight to your smartphone. Available on the Apple App Store and Google Play.

Trump makes bizarre new Ukraine claim hours before crucial meeting

Trump makes bizarre new Ukraine claim hours before crucial meeting

Thieves targeted Melbourne home as family with kids slept inside

Thieves targeted Melbourne home as family with kids slept inside

Cocaine haul worth $26m found inside shipping container

Cocaine haul worth $26m found inside shipping container

Former pilot accused of murdering his wife has bail breach charge dismissed

Former pilot accused of murdering his wife has bail breach charge dismissed

Community devastated as father and son killed while getting ice cream

Community devastated as father and son killed while getting ice cream

App on almost everyone's phone earns Google $55 million fine

App on almost everyone's phone earns Google $55 million fine

Qantas fined $90 million for illegally sacking staff

Qantas fined $90 million for illegally sacking staff

Western Bulldogs player Jamarra Ugle-Hagan caught up in nightclub shooting

Western Bulldogs player Jamarra Ugle-Hagan caught up in nightclub shooting

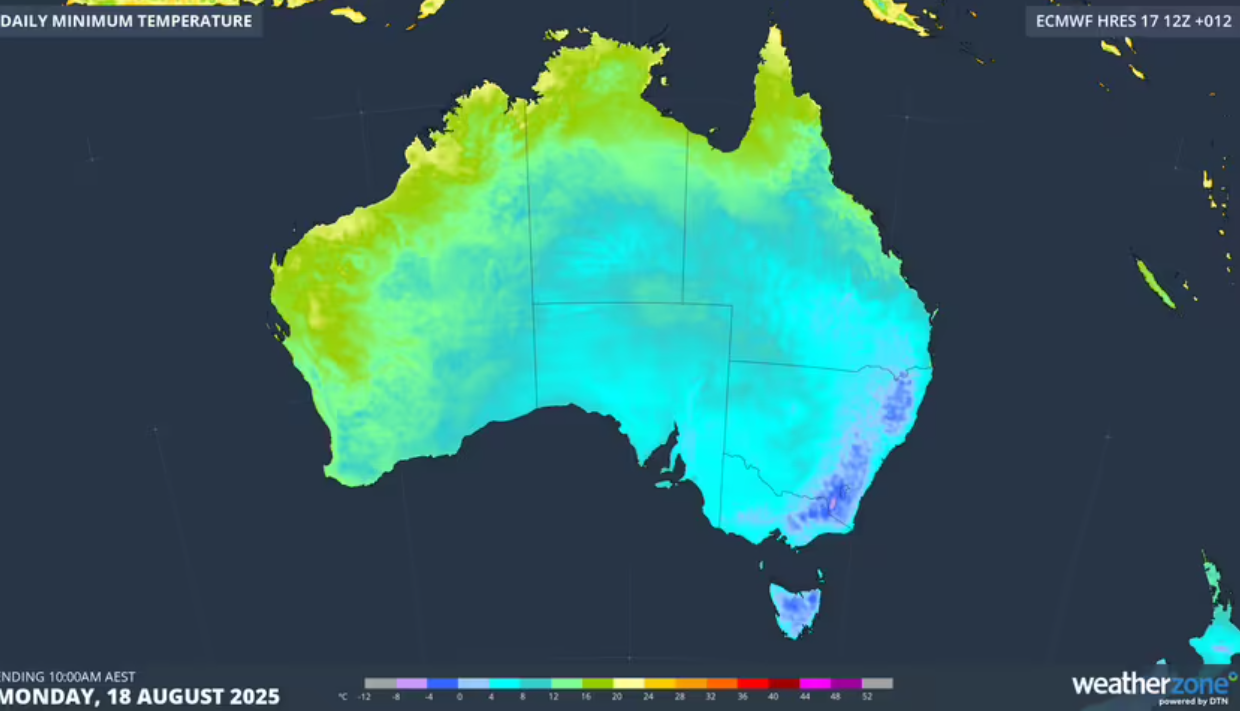

Coldest night of the year recorded as east coast deluge to continue

Coldest night of the year recorded as east coast deluge to continue

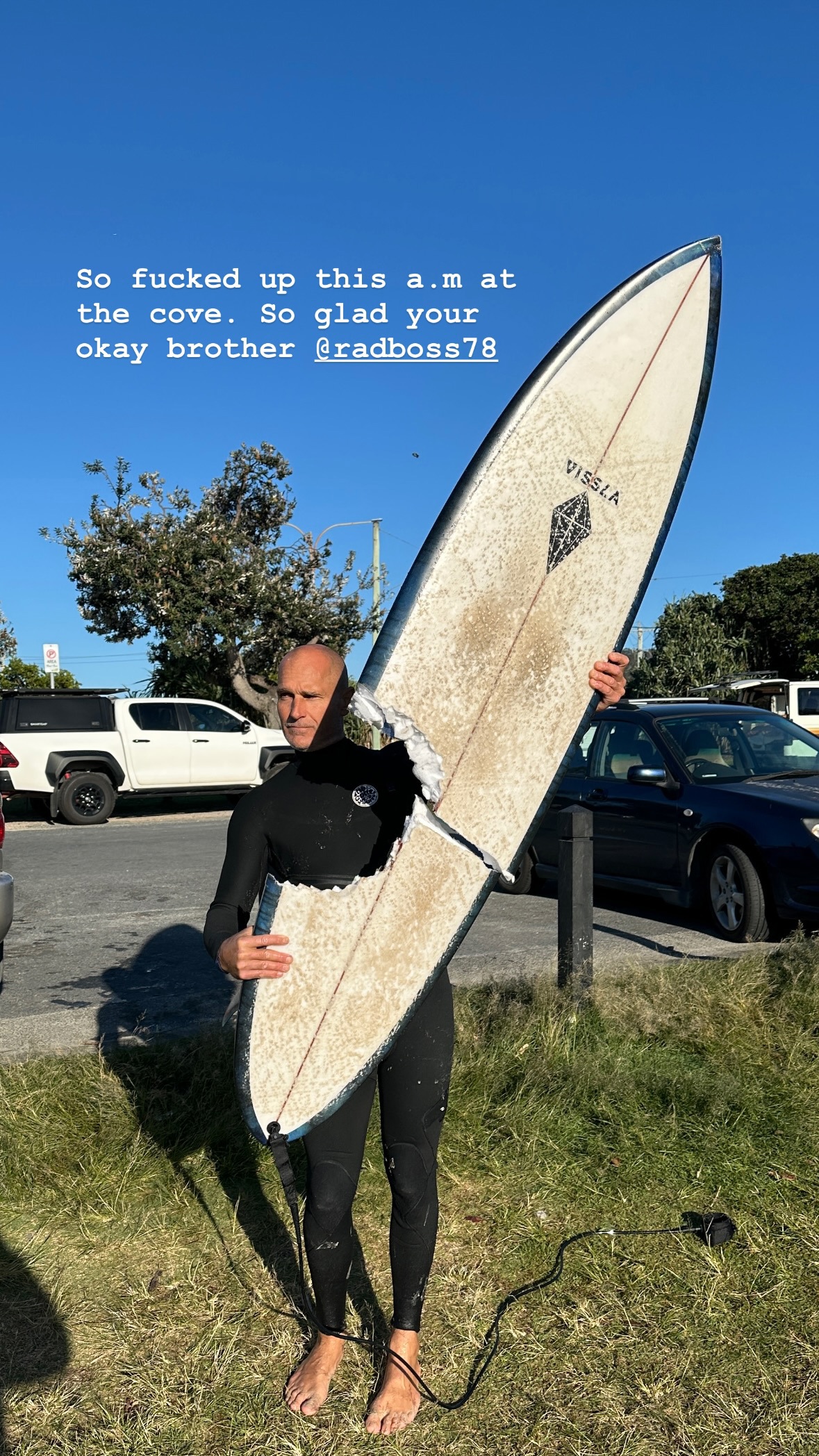

'Insane': Surfer's miracle escape from huge shark at NSW beach

'Insane': Surfer's miracle escape from huge shark at NSW beach

Priscilla, Superman actor Terence Stamp dead at 87

Priscilla, Superman actor Terence Stamp dead at 87

Three charged after Melbourne dad allegedly stabbed 11 times

Three charged after Melbourne dad allegedly stabbed 11 times

Businesses devastated after suspected firebombing in Brisbane

Businesses devastated after suspected firebombing in Brisbane

60 Minutes, 9News scoop multiple honours

60 Minutes, 9News scoop multiple honours

Breathtaking 'stadium effect' captured in eye of rare Hurricane Erin

Breathtaking 'stadium effect' captured in eye of rare Hurricane Erin