The Reserve Bank is hotly tipped to be the Grinch that stole Christmas next week when it holds its final cash rate meeting of the year.

Mortgage holders hoping for a Christmas miracle will be left disappointed next week when the Reserve Bank of Australia (RBA) hands down its decision on interest rates, according to new research.

The unanimous verdict of 35 financial experts in a survey by financial comparison site Finder was the RBA will keep the cash rate at 3.6 per cent next Tuesday.

While 33 of them backed the central bank's expected no change policy to rates, two believed they should be lifted.

READ MORE: Final nail in the coffin for interest rate cut hopes as inflation rises again

Finder head of consumer research Graham Cooke says the clear message for mortgage holders is don't expect any relief soon.

"A hold is still a better outcome than an end-of-year hike, which was being suggested by some analysts – and would have added extra pressure to already stretched household budgets," he said.

"With inflation starting to get away from the RBA, the board appears committed to steady rates for now.

"Any festive rate cuts are firmly off the table, and borrowers will need to prepare for a cautious start to 2026 rather than a sudden reprieve."

The final nail in the coffin for hopes of a cut came last month when data from the Australian Bureau of Statistics showed the country's annual inflation rate rose to 3.8 per cent in the 12 months to October.

The trimmed mean – the Reserve Bank of Australia's preferred measure of underlying inflation – also rose, up from 3.2 to 3.3 per cent.

Maintaining interest rates at their current level will also impact pre-Christmas spending, according to Finder.

Research shows one in three mortgage holders would have enjoyed a more indulgent Christmas with a lower cash rate.

From those surveyed, 55 per cent had even been planning how they'd spend extra cash if rates continued to fall by splashing out on travel, home renovations and shopping for clothes and shoes.

The outlook for potential rates cuts next year remains a mixed picture.

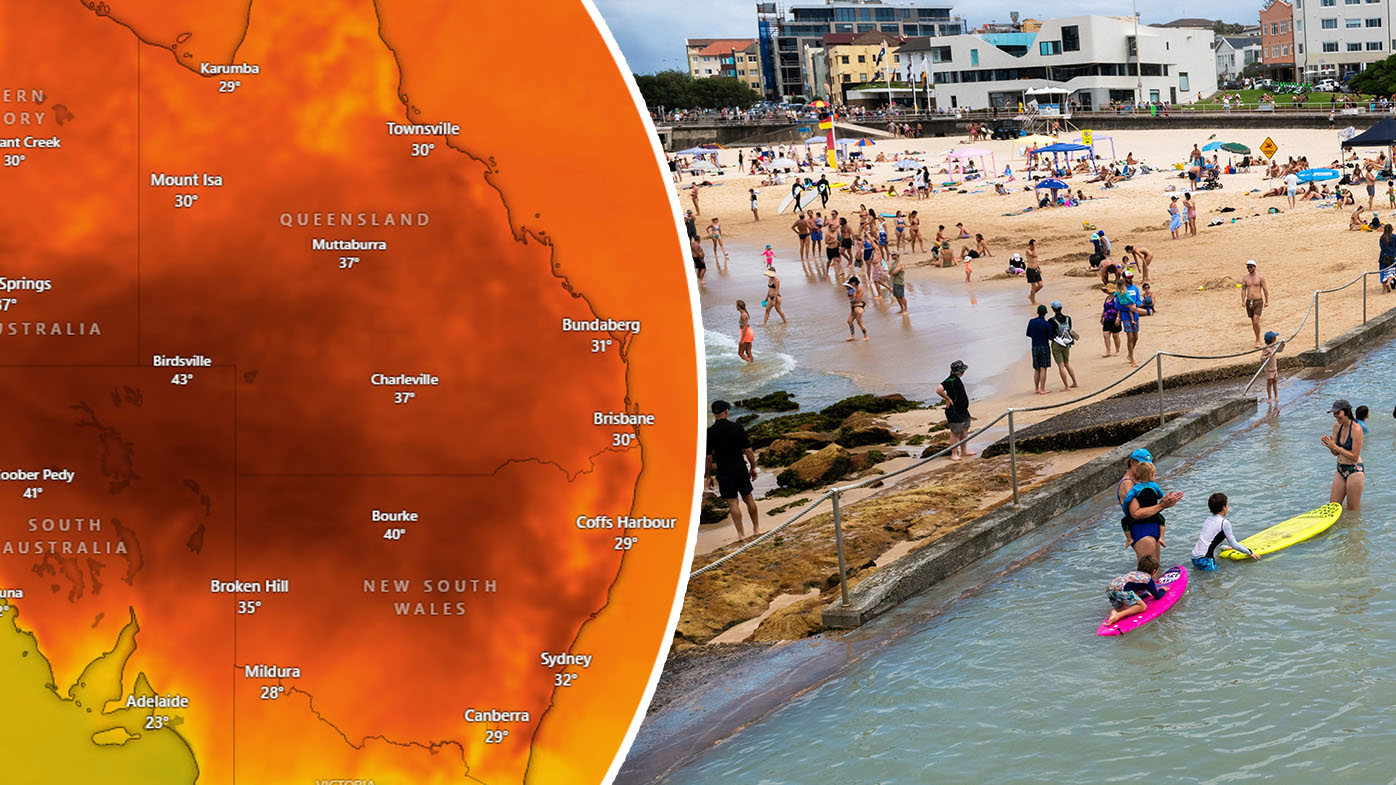

READ MORE: Warning issued as major heatwave grips Sydney

Half of the 28 experts surveyed believe Australia has hit the bottom of the easing cycle, while the other half say there's still room for rates to fall.

Many highlighted one lingering factor: the stubborn level of inflation will loom large over the RBA's cash rate strategy over next year.

More than a third of experts say October's inflation data has "definitely" raised the likelihood of a rate hike within the next six months, while 34 per cent believe it will have little impact.

Sign up here to receive our daily newsletters and breaking news alerts, sent straight to your inbox.

'Balaclavas on their heads and handguns': Shooting erupts at gym

'Balaclavas on their heads and handguns': Shooting erupts at gym

Woman fatally mauled by dog in her home in South Australia

Woman fatally mauled by dog in her home in South Australia

Cash boost for million-plus Aussies in just weeks

Cash boost for million-plus Aussies in just weeks

Man charged with grabbing girl, 12, on Gold Coast

Man charged with grabbing girl, 12, on Gold Coast

Man dead, gunman on the run after Logan shooting

Man dead, gunman on the run after Logan shooting

Retreat or even more bloodshed: Putin's chilling message

Retreat or even more bloodshed: Putin's chilling message

Manhunt for prisoner who escaped from police at hospital

Manhunt for prisoner who escaped from police at hospital

Aussies paying more for private health insurance and getting less

Aussies paying more for private health insurance and getting less

Paris outshines the world in top 100 city rankings

Paris outshines the world in top 100 city rankings

Drama as multiple countries exit from Eurovision in major showdown

Drama as multiple countries exit from Eurovision in major showdown

Warning issued as major heatwave grips Sydney

Warning issued as major heatwave grips Sydney

FBI makes arrest over pipe bombs placed in DC on eve of January 6 riot

FBI makes arrest over pipe bombs placed in DC on eve of January 6 riot

'Such a shame': Arsonists burn down rural town's Christmas tree

'Such a shame': Arsonists burn down rural town's Christmas tree

Owner of German shepherd Arnie faces more charges after case takes bizarre turn

Owner of German shepherd Arnie faces more charges after case takes bizarre turn

Thailand eases alcohol ban to attract more tourists

Thailand eases alcohol ban to attract more tourists

Experts caution against taking medical advice from influencers

Experts caution against taking medical advice from influencers

He loves to hammer 'Sleepy Joe'. He's turning into 'Sleepy Don'

He loves to hammer 'Sleepy Joe'. He's turning into 'Sleepy Don'

Unseen images of Jeffrey Epstein's private island revealed

Unseen images of Jeffrey Epstein's private island revealed