The company announced today it has scrapped its interim dividend for FY26 after recording the massive loss in a tough international wine market.

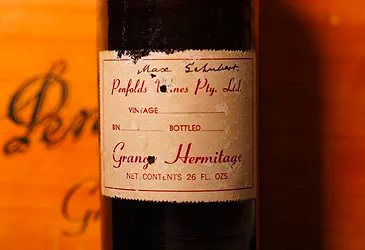

The owner of the iconic Penfolds Wines, Treasury Wine Estates (TWE), has copped an almost $650 million loss.

The Australian company announced today it has scrapped its interim dividend for FY26 after recording a $694.4 million net profit after tax (NPAT) loss as it continues to cut costs in a tough international wine market.

Chief executive Sam Fischer, who has only been in the role since October, said he was confident the company was making progress in strengthening the business and making hard decisions to ensure its longevity.

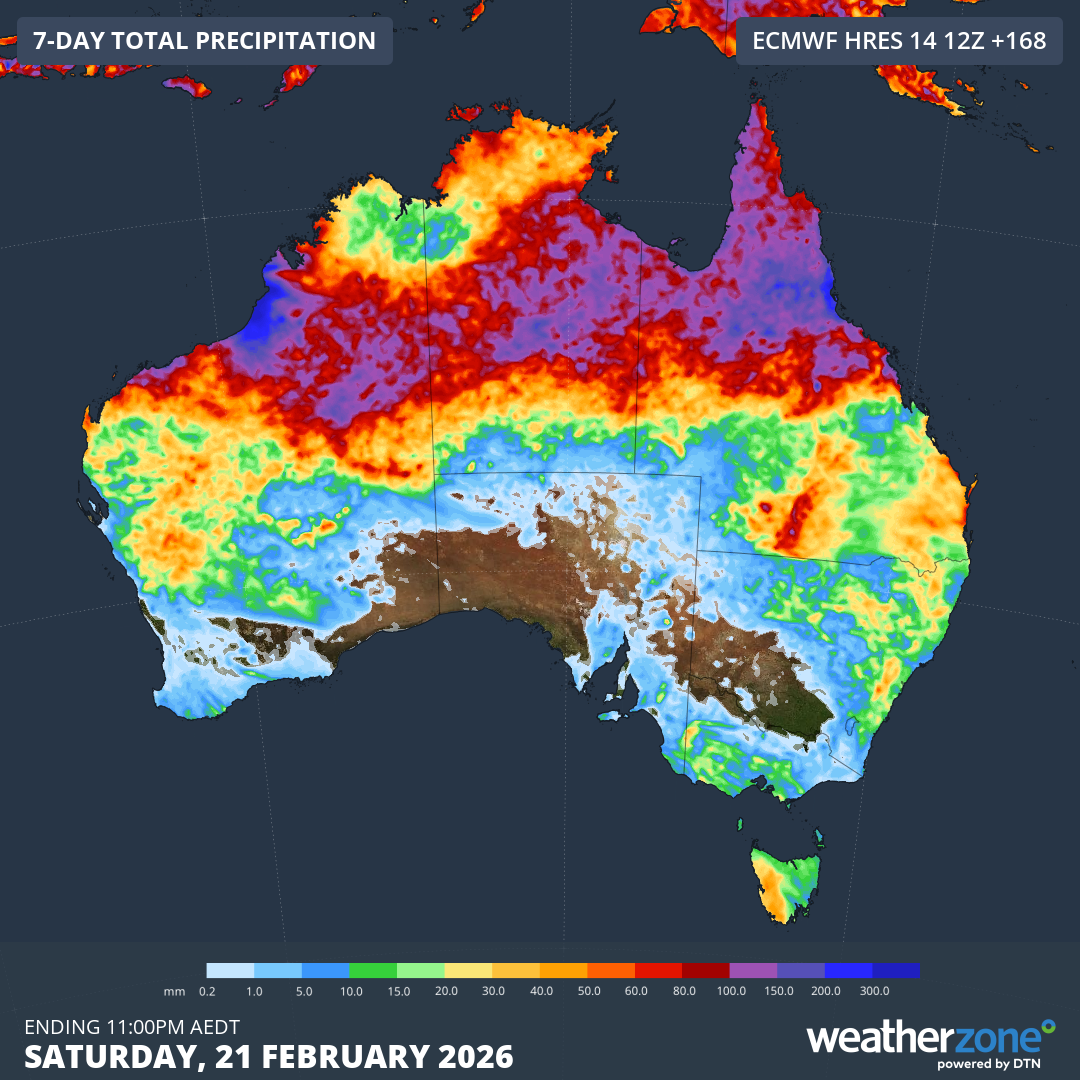

NATIONAL: Half of Australia set for major soaking, millions warned

"Today's results come at a time when we are already making meaningful progress with the decisive actions required to return TWE to a path of sustainable, profitable growth," Fischer said in the announcement to the ASX.

"Our focus is firmly on the future to strengthen execution and ensure we build a stronger, more resilient business for the long term.

Treasury Wines Estates portfolio includes popular labels DAOU, Stags' Leap, Pepperjack, Squealing Pig, 19 Crimes and Matua.

Critically, the company suffered $751 million in impairments in its American wine business.

Profit in the Americas was down almost 64 per cent.

However, Fisher said profits in the second half were expected to improve with the Californian market expected to pick up.

Profits in the Penfolds division alone fell almost 20 per cent, although the company insists the brand remains strong.

"Encouragingly, we are seeing our key brands continue to perform in the marketplace and resonate strongly with consumers, reinforcing confidence in the strength of our portfolio and our ability to deliver improved performance as we execute the transformation of the business," Fischer said.

NEVER MISS A STORY: Get your breaking news and exclusive stories first by following us across all platforms.

- Download the 9NEWS App here via Apple and Google Play

- Make 9News your preferred source on Google by ticking this box here

- Sign up to our breaking newsletter here

Coles accused of 'utterly misleading' grocery prices

Coles accused of 'utterly misleading' grocery prices

The health insurance mistake costing Aussies $828 a year

The health insurance mistake costing Aussies $828 a year

One man dead, tens of thousands without power as storms batter New Zealand

One man dead, tens of thousands without power as storms batter New Zealand

Accused Bondi terrorist Naveed Akram appears in court for the first time

Accused Bondi terrorist Naveed Akram appears in court for the first time

Man arrested after woman found dead at home in Melbourne's east

Man arrested after woman found dead at home in Melbourne's east

China expands visa-free travel to two new countries

China expands visa-free travel to two new countries

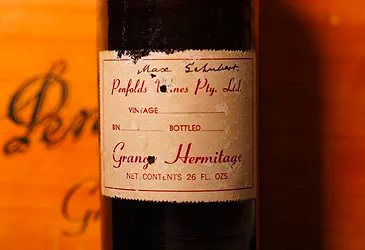

'Distressing' video of mistakenly kidnapped Sydney grandfather seen by police

'Distressing' video of mistakenly kidnapped Sydney grandfather seen by police

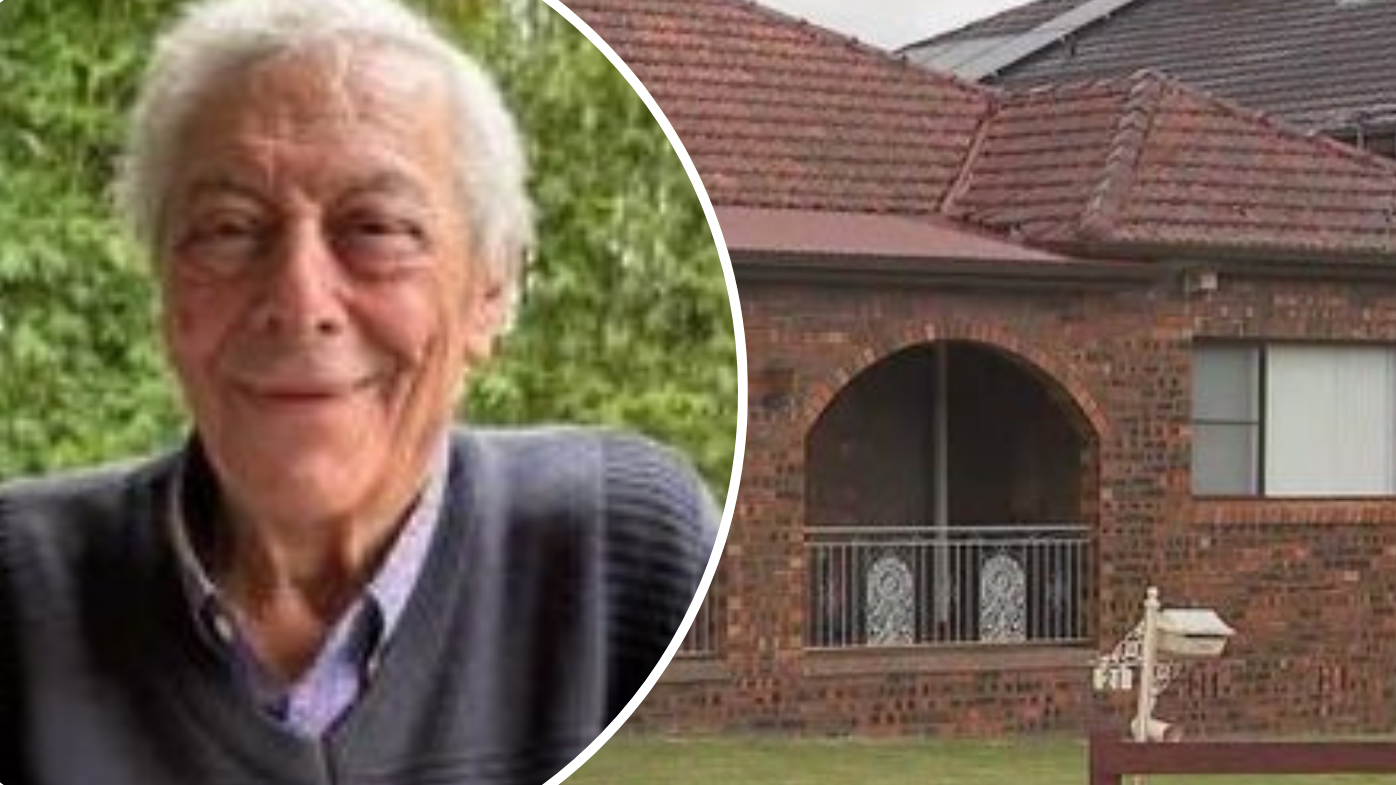

BoM defends 300mm rain 'deluge' that turned out to be a drizzle

BoM defends 300mm rain 'deluge' that turned out to be a drizzle

Police return to family home where missing boy Gus Lamont was last seen

Police return to family home where missing boy Gus Lamont was last seen

'It's never too late: US TV host pleads with mum's suspected kidnappers

'It's never too late: US TV host pleads with mum's suspected kidnappers

Half of Australia set for major soaking, millions warned

Half of Australia set for major soaking, millions warned

Mystery blast burns boats and forces restaurant to evacuate

Mystery blast burns boats and forces restaurant to evacuate

Teens pinned to wall by out-of-control car skidding into takeaway shop

Teens pinned to wall by out-of-control car skidding into takeaway shop