Twelve months ago, mortgage holders were looking forward to a new year that promised to be full of interest rate cuts. The outlook now, though, is considerably bleaker.

Twelve months ago, mortgage holders were looking forward to a new year that promised to be full of interest rate cuts.

The outlook now, though, is considerably bleaker.

This is what we know about what interest rates might do in 2026.

READ MORE: One-in-five mortgage holders rue taking on huge home loans

Will interest rates rise in 2026?

It's possible, and some banks think we'll get a hike as soon as February 3.

"With what we know at the moment, I don't think there are interest rate cuts on the horizon for the foreseeable future," RBA Governor Michele Bullock said after the central bank's final rates decision of the year on December 9.

"The question is, is it just an extended hold from here, or is it a possibility of a rate rise?

"They are the two things the board will be looking closely at coming into the new year."

Those hawkish comments have led a range of economists to tip a rate hike in 2026.

Commonwealth Bank head of Australian economics Belinda Allen says the first meeting of the year will be a live one, and both CBA and NAB are predicting a 25-basis-point increase on the first meeting of the year.

NAB has forecast even more pain, pencilling in a further cut in May.

The market is more pessimistic.

READ MORE: The state where parking in the wrong spot could cop you a $3300 fine

The market has been pricing in around a 27 per cent chance of a hike in February (that figure has been both slightly higher and lower throughout late December, but was at zero at the start of the month), and an end-year cash rate of about 4 per cent.

Not everyone agrees with that, though.

The other half of the big four banks, Westpac and ANZ, are predicting a year of holds, as are some economists.

"We expect to see the cash rate remain at 3.6 per cent in 2026, with the swing back to rate hikes more a story for 2027," AMP chief economist Shane Oliver wrote.

"But we concede that the risks look like they are now a bit more to the upside on rates in 2026.

"However, our assessment is that the swing in the money market from expecting 2 or 3 more cuts after the August RBA meeting to now expecting nearly two hikes (in 2026) is premature and a bit too extreme."

READ MORE: What are the public holidays during the Christmas and New Year period?

Why aren't interest rates expected to come down?

Casual observers – particularly those with a mortgage – might be wondering why we're suddenly talking about the prospect of rate hikes, not cuts.

After all, it was only a few months ago that economists were talking about the cash rate settling around 3.1 per cent.

The reason for the turnaround is an unexpected surge in inflation.

Having fallen back into the central bank's target band of 2-3 per cent, the consumer price index (CPI) jumped to 3.2 per cent in the September quarter and again to 3.8 per cent in October, with underlying inflation not too far behind.

READ MORE: Australia's most annoying driving habit could cost you more than $500 in fines

The data-driven RBA will get two new batches of inflation figures before its February decision – for November on January 7 and December on the 28th.

If inflation cools off, so too will the chance of a rate hike.

But if it comes in hot once again, then mortgage holders will have every right to feel nervous about the first rates decision of the year.

"If trimmed mean inflation in the December quarter does not fall back as we expect (and comes in around 0.9 per cent quarter-on-quarter or more), then a hike as early as February is possible," Oliver said.

"December quarter CPI inflation is the key to what happens early next year on rates."

The information provided on this website is general in nature only and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information on this website you should consider the appropriateness of the information having regard to your objectives, financial situation and needs.

'A nightmare': Dozens feared dead in New Year's Eve fire at Swiss Alps bar

'A nightmare': Dozens feared dead in New Year's Eve fire at Swiss Alps bar

Aussie cattle farmers dealt blow as China slaps cap on beef imports

Aussie cattle farmers dealt blow as China slaps cap on beef imports

Three drowning deaths, two people missing in horror 36 hours in NSW

Three drowning deaths, two people missing in horror 36 hours in NSW

Teen charged after firecracker sparks serious bushfire during NYE celebrations

Teen charged after firecracker sparks serious bushfire during NYE celebrations

Ex-prosecutor tells Congress he had enough to convict Trump

Ex-prosecutor tells Congress he had enough to convict Trump

Welfare boost, cash mandate, higher costs: All the changes in effect from today

Welfare boost, cash mandate, higher costs: All the changes in effect from today

Queen Camilla reveals indecent assault as a teen for first time

Queen Camilla reveals indecent assault as a teen for first time

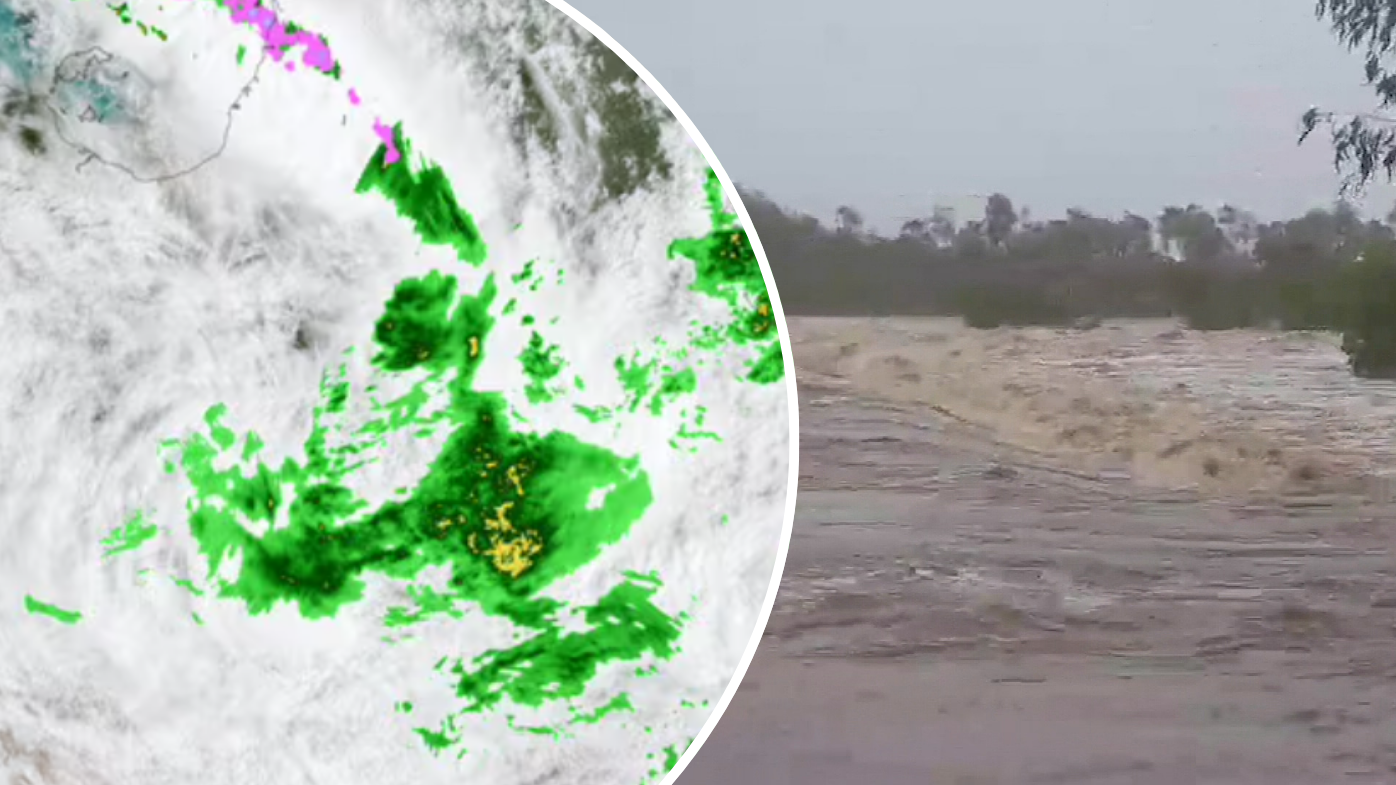

Monsoonal deluge continues to batter northern Queensland

Monsoonal deluge continues to batter northern Queensland

The morning habit an influencer, Olympian, and executive all swear by

The morning habit an influencer, Olympian, and executive all swear by

Happy New Year! Australia begins 2026

Happy New Year! Australia begins 2026

Sam Kerr and Kristie Mewis marry in private ceremony in Perth

Sam Kerr and Kristie Mewis marry in private ceremony in Perth

World parties at New Year's Eve celebrations to bring an end to 2025

World parties at New Year's Eve celebrations to bring an end to 2025

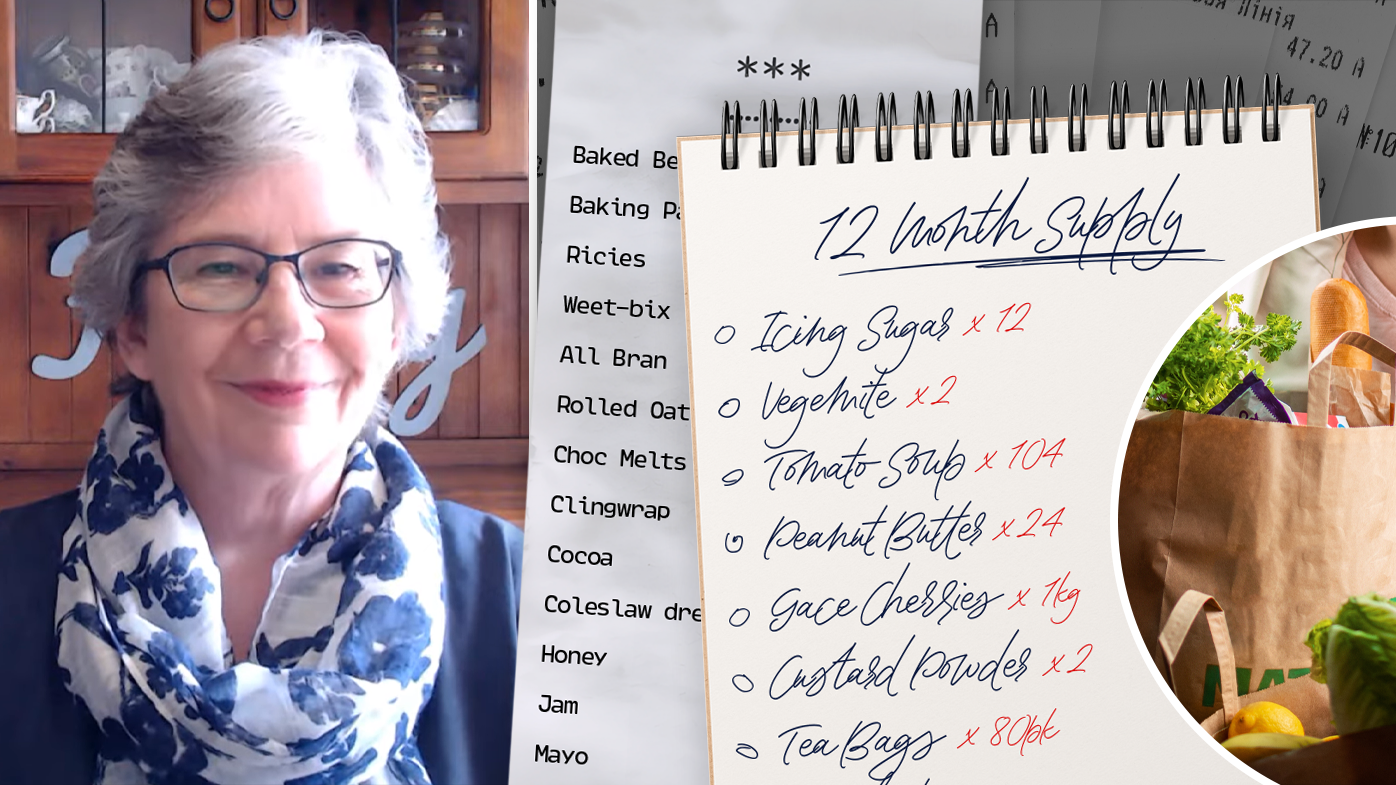

Cath restocks her pantry once a year. She's already planned her meals for 2026

Cath restocks her pantry once a year. She's already planned her meals for 2026

Two men injured after stolen car ploughs into power pole following traffic stop

Two men injured after stolen car ploughs into power pole following traffic stop

Good news in new poll for Hanson - but who is our most-liked politician?

Good news in new poll for Hanson - but who is our most-liked politician?

Queensland floods turn deadly as rain continues to pour

Queensland floods turn deadly as rain continues to pour

Three people mauled by dog in NSW

Three people mauled by dog in NSW

200kgs worth of shark heads left outside MP's office

200kgs worth of shark heads left outside MP's office