The maximum amount an average earner can borrow from the bank will fall by $12,000 overnight if rates are hiked tomorrow.

Prospective home owners are set to see their purchasing power slashed by thousands of dollars overnight if the forecast RBA rate hike goes ahead tomorrow.

The maximum amount a person earning the average Australian wage of $104,807 can borrow from the bank will fall by around $12,000 from tomorrow, if the RBA hikes interest rates by 0.25 percentage points, new analysis by Canstar reveals.

Headline inflation has shot up to 3.8 per cent in the year to December, while the trimmed mean increased to 3.3 per cent data released last week shows - both well outside the central bank's target band.

READ MORE: 'Reputation' test looming for Pauline Hanson amid One Nation surge

The new data has prompted economists at all four major banks to predict a 0.25 percentage point increase in the cash rate to 3.85 per cent.

A second rate hike of 0.25 percentage points is also being forecast by NAB at the next RBA meeting in May.

If that eventuates, an average wage earner's borrowing power will be reduced by $24,000.

For a couple who both earn the average wage, that figure would be $48,000.

This is based on a person taking out an owner-occupier loan with no other debts, no dependents and minimum expenses.

The forecast rate hike is also casting shadows over mortgage holders' prospects.

An owner-occupier with a $600,000 mortgage and 25 years remaining on their loan would see their minimum monthly repayments rise by $90, assuming banks pass the hike on to their variable customers.

For those with a $1 million loan, that figure is $150.

READ MORE: New search for accused police shooter Dezi Freeman

"One RBA hike in isolation isn't going to blow up home buying budgets en masse, but it could push some buyers to the sidelines until they get a clearer idea of just how many hikes might be on the horizon," Canstar's insights director Sally Tindall said.

"Growth in property prices could well slow on the back of a return to rate hikes, but it's unlikely to see prices fall.

"Home buyers should take this as a warning sign that rates could go higher and stay that way for a considerable period of time."

NEVER MISS A STORY: Get your breaking news and exclusive stories first by following us across all platforms.

- Download the 9NEWS App here via Apple and Google Play

- Make 9News your preferred source on Google by ticking this box here

- Sign up to our breaking newsletter here

Triple murder suspect sighted days after alleged deadly rampage

Triple murder suspect sighted days after alleged deadly rampage

Nationals leader David Littleproud survives failed leadership spill

Nationals leader David Littleproud survives failed leadership spill

Osbournes in tears as A-listers honour Ozzy at Grammys

Osbournes in tears as A-listers honour Ozzy at Grammys

Community rewards Rabbi's selfless act during Bondi terror attack

Community rewards Rabbi's selfless act during Bondi terror attack

Man, 25, charged with murder over death of newborn baby

Man, 25, charged with murder over death of newborn baby

Accused 'Pam the Bird' graffitist to face trial

Accused 'Pam the Bird' graffitist to face trial

Australian woman dies at ski resort in Japan

Australian woman dies at ski resort in Japan

Police believe accused cop killer Dezi Freeman could be dead as fresh search begins

Police believe accused cop killer Dezi Freeman could be dead as fresh search begins

New capital joins $1 million house club

New capital joins $1 million house club

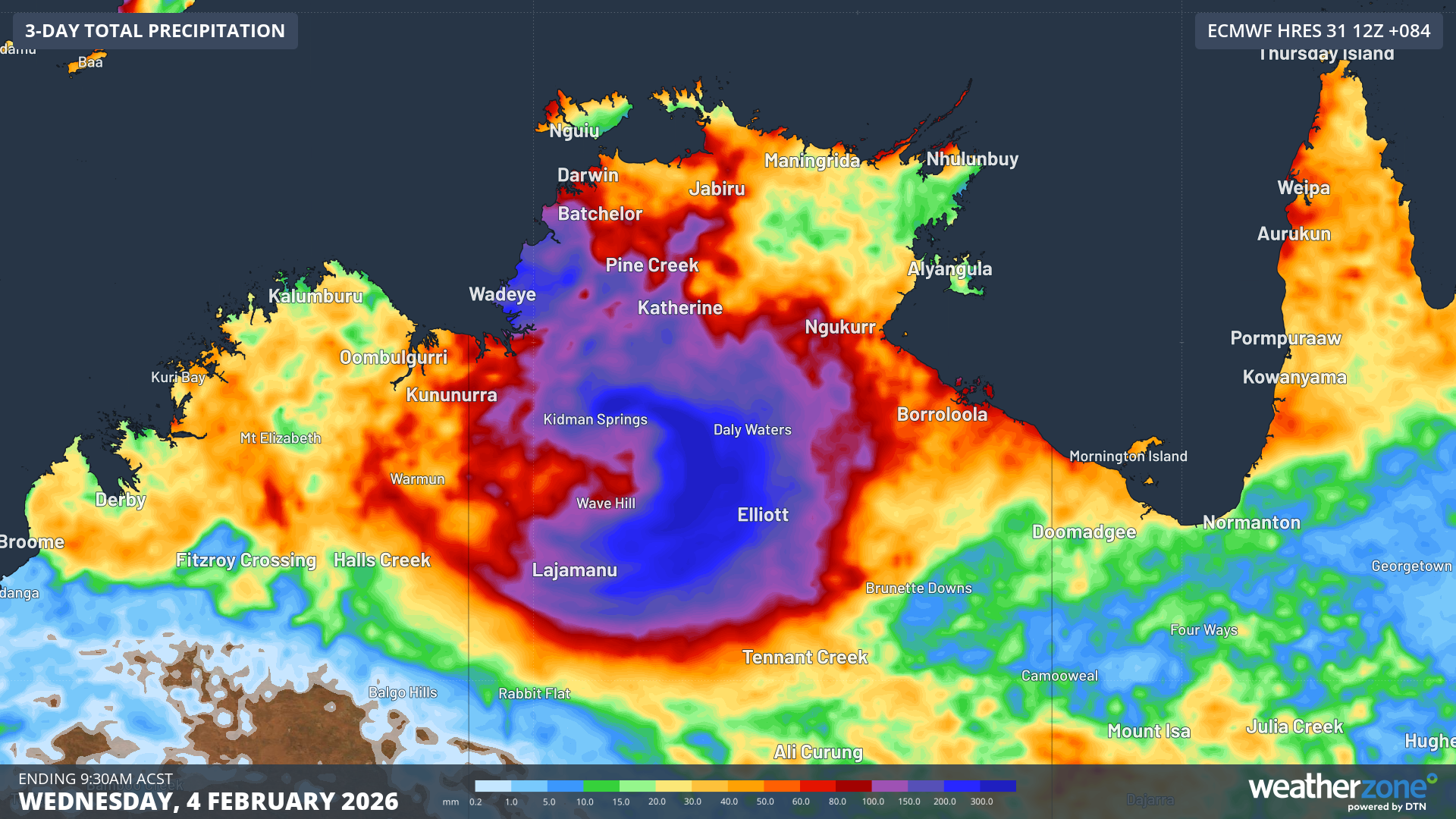

Aussie territory set to cop a drenching this week

Aussie territory set to cop a drenching this week

ICE detained boy, 5. Judge ordered him released with scathing takedown

ICE detained boy, 5. Judge ordered him released with scathing takedown

Parents of Sydney Harbour shark attack victim, 12, join poignant Bondi paddle out

Parents of Sydney Harbour shark attack victim, 12, join poignant Bondi paddle out

'Confusion, anxiety': Expats from one country urged to check citizenship status

'Confusion, anxiety': Expats from one country urged to check citizenship status