The unemployment rate has remained steady to start 2026, with more people in work than economists had expected in a move that could aid the case for a second interest rate hike this year.

The unemployment rate has remained steady in January 2026, surprising economists with hotter-than-expected labour force figures that could aid the case for a second interest rate hike this year.

New data from the Australian Bureau of Statistics (ABS) revealed the jobless rate remained at 4.1 per cent in January, better than the predicted rise to 4.2 per cent analysts had predicted.

"Employed people grew by 18,000. Full-time employment rose by 50,000 people, partly offset by a fall of 33,000 people in part-time employment," ABS head of labour statistics Sean Crick said.

READ MORE: Man charged over alleged death threats to Treasurer Jim Chalmers

"The participation rate of 66.7 per cent was 0.6 percentage points lower than the record high measured in January 2025.

"The underemployment rate rose 0.2 percentage points to 5.9 per cent in January. The underutilisation rate also grew by 0.2 percentage points to 10.0 per cent.

"Youth underemployment rose 1.0 percentage point to 14.8 per cent. This rise largely reversed the fall recorded last month."

While the creation of 50,000 new full-time jobs is a boost for the economy, it could give the Reserve Bank a stronger case to hand down a second interest rate hike in the first half of the year.

The RBA's monetary policy board next meets in mid-March, where it is considered likely to keep the cash rate on hold at 3.85 per cent.

FINANCE: Surprise benefit households get from stronger Aussie dollar

However, three of the big four banks are forecasting a hike to 4.10 per cent at the following meeting on May 5, when the board will have a fresh batch of quarterly inflation figures to inform its decision.

"For the RBA, the message is clear: the labour market remains firm," Oxford Economics head of economic research Harry Murphy Cruise said.

"On its own, this strength doesn't justify additional tightening beyond the hike we expect in May.

"But if we find ourselves with a lineball decision later in the year, ongoing resilience in employment and wages could be the deciding factor that tips the board toward further tightening."

NEVER MISS A STORY: Get your breaking news and exclusive stories first by following us across all platforms.

- Download the 9NEWS App here via Apple and Google Play

- Make 9News your preferred source on Google by ticking this box here

- Sign up to our breaking newsletter here

TV host lashes his own network for stopping interview being aired

TV host lashes his own network for stopping interview being aired

US ready for military strike this weekend, sources say

US ready for military strike this weekend, sources say

Australian man charged with child sex offences after airport luggage find

Australian man charged with child sex offences after airport luggage find

Australia heads world table for fatal shark attacks

Australia heads world table for fatal shark attacks

Aussies back tax hike after senator's beer vs gas exchange goes viral

Aussies back tax hike after senator's beer vs gas exchange goes viral

Trump warns UK against giving away key military base

Trump warns UK against giving away key military base

Council apologises after drivers overpay on hundreds of parking fines

Council apologises after drivers overpay on hundreds of parking fines

'As good as it gets': Bank's bleak warning to every Australian

'As good as it gets': Bank's bleak warning to every Australian

Perth council offers $50 reward in new bin sorting crackdown

Perth council offers $50 reward in new bin sorting crackdown

The super mistake which could cost young Aussies $128,000

The super mistake which could cost young Aussies $128,000

'ISIS bride' banned from returning, minister confirms passports

'ISIS bride' banned from returning, minister confirms passports

Surprise benefit households get from stronger Aussie dollar

Surprise benefit households get from stronger Aussie dollar

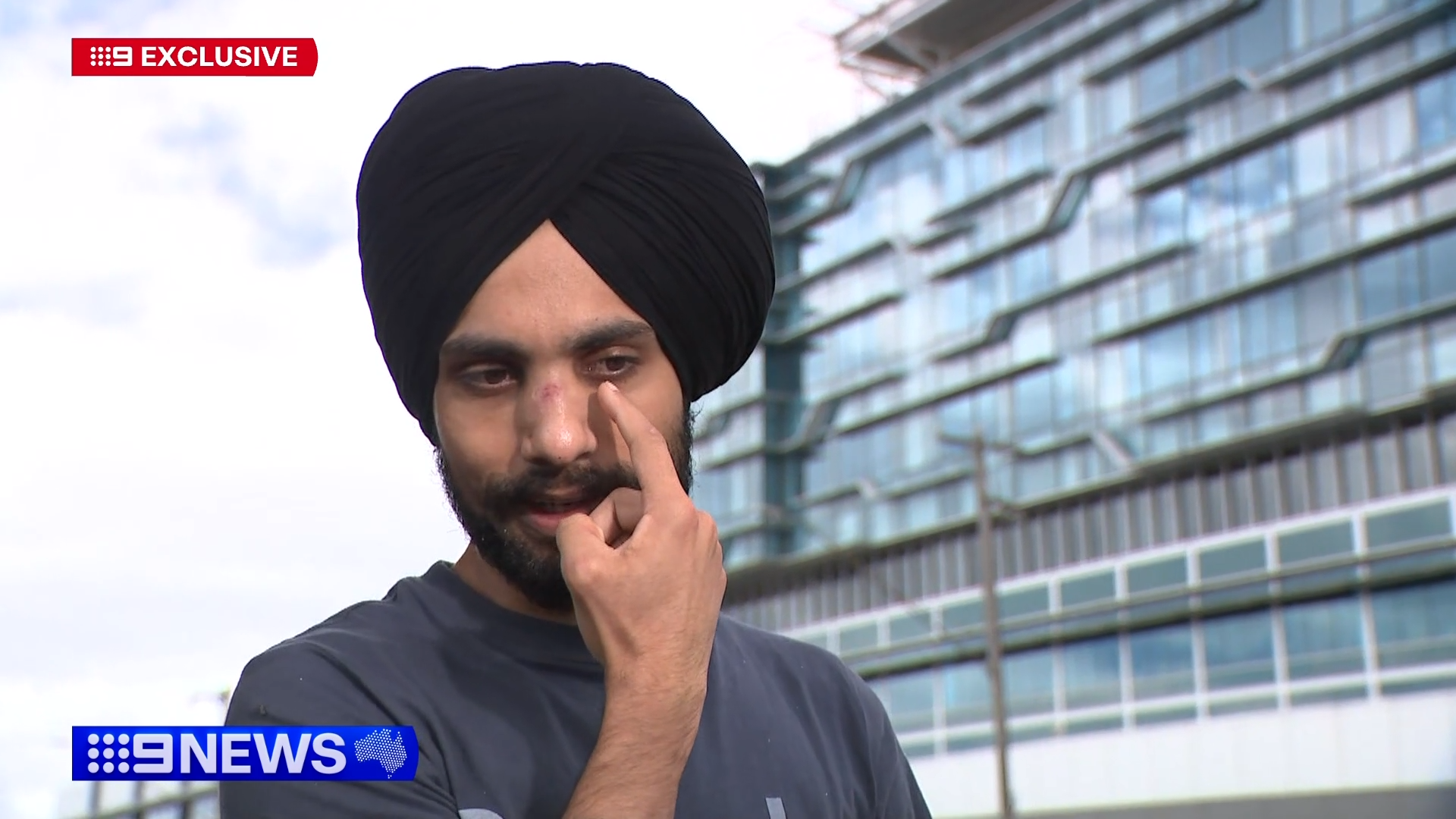

Nurse assaulted in alleged racist attack at Geelong gym

Nurse assaulted in alleged racist attack at Geelong gym

Sydney was the hottest place in Australia before a sudden downpour

Sydney was the hottest place in Australia before a sudden downpour

NSW's new public holiday to bring financial pressures to small businesses

NSW's new public holiday to bring financial pressures to small businesses